Video game retailer GameStop (GME) is scheduled to announce its results for the second quarter of Fiscal 2025 after the market closes on Tuesday, September 9, 2025. Wall Street expects GameStop to report EPS (earnings per share) of $0.19 for Q2 FY25, marking a significant jump from $0.01 in the prior-year quarter. Meanwhile, revenue is estimated to increase by about 13% to $900 million.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While these estimates reflect an improvement in financials due to GME’s cost reduction initiatives and strength in collectibles business, investors remain concerned about the persistent weakness in the core hardware and software business, as well as the pivot toward other areas, such as digital assets.

Investors Remain Concerned About GME’s Growth Potential

The meme stock is down about 26% year-to-date due to macro uncertainty, weakness in the core business, and other company-specific risks, including concerns about the strategy to grow beyond the traditional retail business into digital assets and other revenue streams.

Notably, investors are concerned about GameStop’s pivot toward crypto, as the company invests its cash in Bitcoin (BTC-USD) in an attempt to mimic the success of Strategy (MSTR), which has emerged as the largest corporate holder of the flagship cryptocurrency.

Investors will pay attention to management’s commentary about the company’s strategic initiatives, including cost reduction efforts, and the ability to deliver sustainable profits. They would also seek more insights on the company’s Bitcoin investment and updates on how it intends to deploy its huge cash balance of more than $6 billion.

AI Analyst Is Cautious on GameStop Stock Ahead of Q2 Print

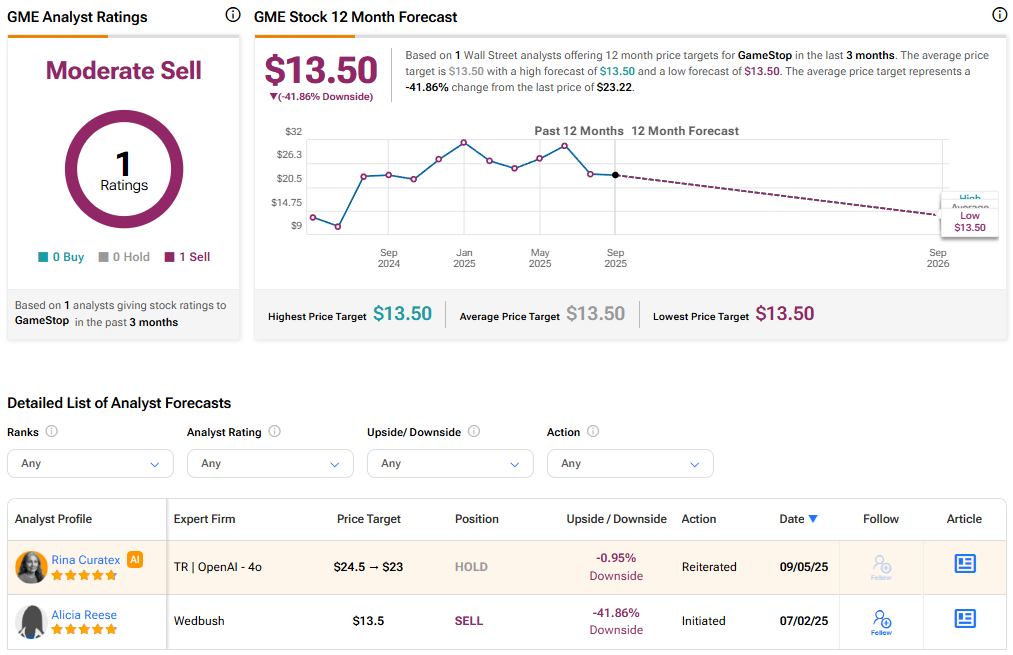

Interestingly, TipRanks’ AI Analyst has assigned a Neutral rating to GameStop stock with a price target of $23, indicating a possible downside of 0.95%. AI analysis highlighted improvements in profitability and cash flow. However, technical indicators suggest bearish momentum, and GME stock’s high P/E ratio indicates potential overvaluation.

The AI Analyst contends that while GameStop’s strategic “financial maneuvers” are positive, they are already factored into the financial performance score.

Options Traders Anticipate a Major Move on GME’s Q2 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders expect a 10.3% move in either direction in GME stock in reaction to Q2 FY25 results.

Is GME Stock a Buy, Sell, or Hold?

Given the weakness in the core business, uncertainty surrounding Bitcoin, and meme stock-related volatility, GameStop has a Moderate Sell consensus rating. Notably, Wedbush analyst Alicia Reese has a Sell rating on GameStop stock with a price target of $13.50, indicating a downside risk of about 42% from current levels.