Not so long ago, we heard that aerospace stock Boeing (BA) was facing something of a crossroads, as a host of its cargo aircraft were starting to come due for retirement. But Boeing appears to have the next generation of freight aircraft well in hand with the 777-8F plane. Investors are pleased that the next generation is ready to go, and gave shares a fractional boost in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It has been called “…the future of long-haul cargo transport,” and came about when Qatar Airways first noted to Boeing that its 777F line was showing its age. The airline urged Boeing to bring out a new version of the 777X line, specifically geared toward cargo transport. Thus, the 777-8F was born, reports noted, and Qatar Airways put in an order for 34 of them, with another 16 available as an option.

It was, at the time, Boeing’s single-largest cargo aircraft deal, and with good reason. The 777-8F actually has 17% greater volume than the earlier model, with maximum payload that is in striking distance of the 747-400F. Plus, the 777-8F offers a range of over 5,000 miles, even fully loaded. This makes for a highly versatile aircraft with top-notch fuel efficiency and improved operating costs.

A Surprising Upgrade

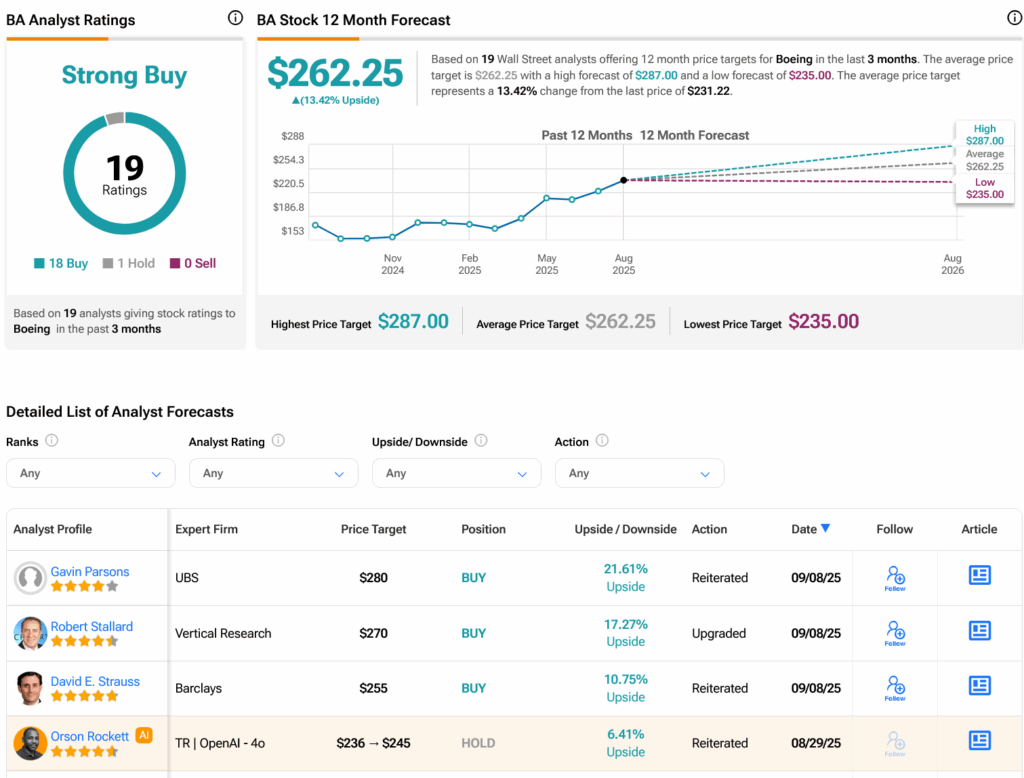

Meanwhile, word from Robert Stallard with Vertical Research Partners—who has nearly a five-star rating on TipRanks—recently bumped up his rating on Boeing to Buy. That might surprise some outside viewers, but Stallard had some noteworthy points to consider.

First, the aerospace industry is currently moving into a “mid-cycle environment,” with revenue growth expected to normalize, and supply chain issues are starting to calm down. That is good news all around, and especially for Boeing, as it becomes the leading name to benefit from such an environment. There may still be risks with fixed-price contracts, but recent stabilization in the market suggests these risks may be paring back.

Is Boeing a Good Stock to Buy Right Now?

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 18 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 40.94% rally in its share price over the past year, the average BA price target of $261.24 per share implies 13.42% upside potential.