Investing in healthcare mutual funds is worth considering for those seeking both returns and exposure to a resilient industry. Moreover, mutual fund investments have several benefits, such as diversification, higher liquidity, and low minimum investment requirements. Today, we have focused on two healthcare mutual funds – FSHCX and VGHCX – with over 10% upside potential projected by analysts in the next twelve months.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Let’s delve deeper.

Fidelity Select Health Care Services Portfolio (FSHCX)

The FSHCX fund aims to invest in companies that own or manage hospitals, nursing homes, health maintenance organizations, and other companies specializing in the delivery of healthcare services. As of today, FSHCX has 26 holdings with total assets of $1.63 billion. Moreover, the fund has generated returns of about 9% over the past six months.

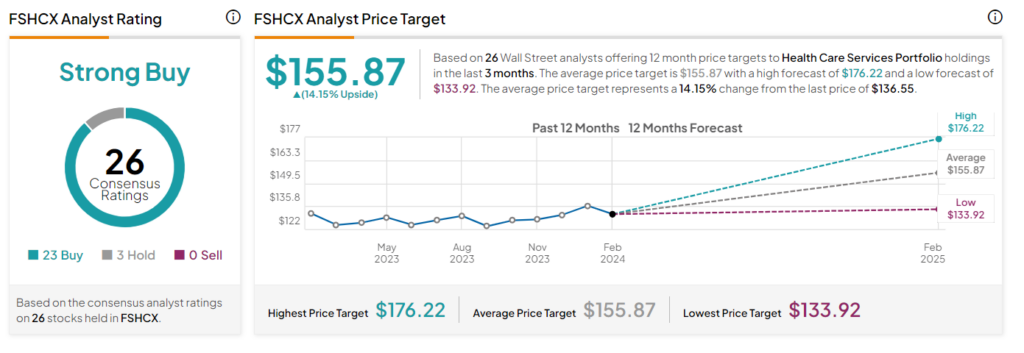

On TipRanks, FSHCX has a Strong Buy consensus rating. This is based on 23 stocks with a Buy rating and three stocks with a Hold rating. The average FSHCX mutual fund price target of $155.87 implies 14.2% upside potential from the current levels.

Vanguard Specialized Portfolios Health Care Fund (VGHCX)

The VGHCX fund seeks long-term capital appreciation. Also, it invests at least 80% of its assets in companies engaged in the development and production of products and services related to the healthcare industry. As of today, VGHCX has 97 holdings with total assets of $42.91 billion. Over the past six months, the VGHCX fund has gained nearly 8%.

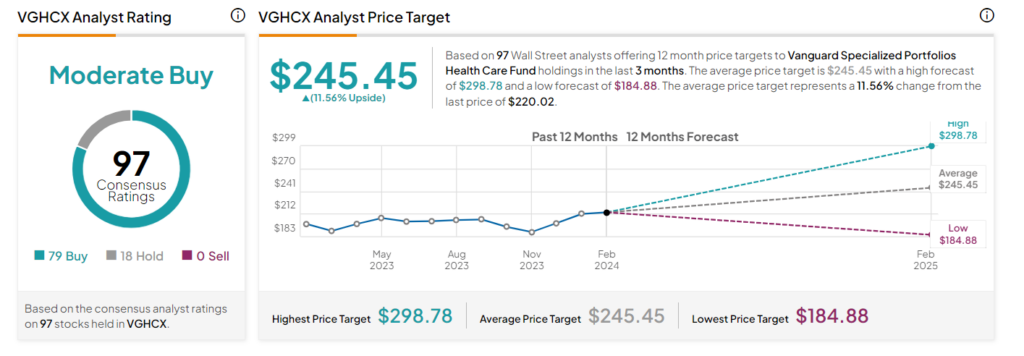

VGHCX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 97 stocks held, 79 have Buy recommendations and 18 have a Hold rating. The average VGHCX fund price target of $245.45 implies an 11.6% upside potential from the current levels.

Concluding Thoughts

Mutual funds are considered a safer choice for investors, as they offer several benefits, including diversification and higher liquidity in comparison to individual stocks. However, a prudent approach necessitates in-depth research before investing.