Shares of France-based Societe Generale, or SocGen (FR:GLE) fell sharply by almost 9% yesterday after the bank issued a grim outlook for its Retail segment in its half-yearly results for 2024. The bank now expects its retail net interest income to be €3.8 billion in 2024, which is €300 million lower than the previous estimate. The bank attributed this to a rise in interest-bearing deposits and lower loan demand.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Societe Generale is a well-known European financial institution, serving around 25 million customers.

Top Takeaways from SocGen’s H1 Results

In the first half, Societe Generale reported a 2.9% year-over-year increase in its revenue to €13.3 billion. However, the top line was down by 0.5% on constant exchange rates. The bank generated a net income of €1.8 billion in the first half, marking a growth of 1.4% over the same period last year.

Meanwhile, in the second quarter, SocGen’s performance showed significant improvement, aligning with its full-year targets. In Q2, the bank’s revenue grew by 6%, while net profit increased to €1.11 billion from €900 million in the prior-year quarter.

The bank stated that its quarterly performance was mainly driven by the Global Banking and Investor Solutions segment, which saw a significant 10% year-over-year rise in its revenue. Within this segment, the Equities business again achieved outstanding results, registering a 24.4% revenue growth.

On the other hand, the Retail, Private Banking, and Insurance segment delivered subdued performance. Revenue grew 1.1% to €2.1 billion, but the segment was impacted by short-term hedges made by the bank during a low interest rate environment.

Is Societe Generale a Buy or Sell?

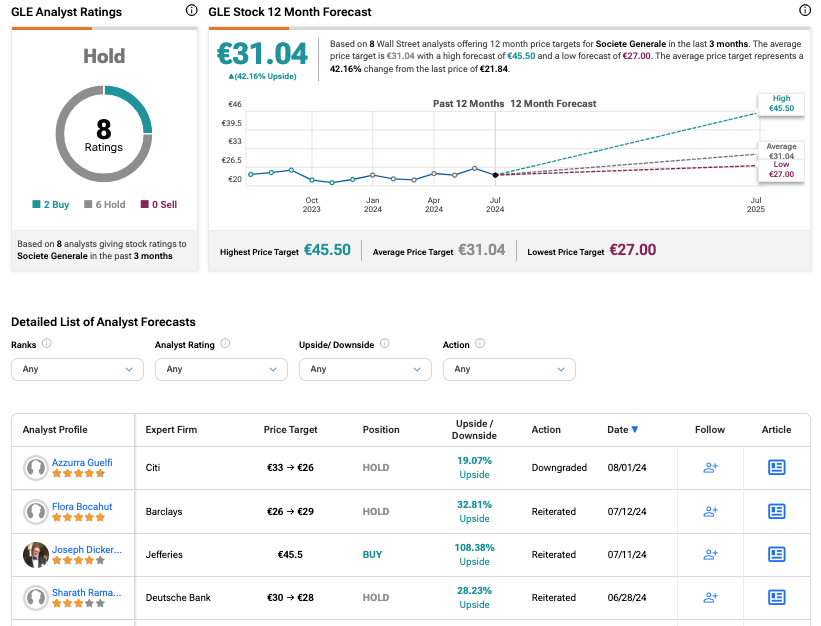

Post-results, Citi downgraded its rating on GLE stock from Buy to Hold, predicting an upside of 19.07%.

Overall, on TipRanks, GLE stock has received a Hold rating based on two Buy and six Hold recommendations. The Societe Generale share price forecast of €31.04 implies an upside potential of 42% on the current trading price. Shares are down 11.3% year-to-date.