Fortinet (NASDAQ:FTNT), a leading cybersecurity firm, sent shockwaves through the market by lowering its full-year sales outlook, causing its stock to plummet more than 14% in extended trading hours. The company now projects sales to land somewhere between $5.35B and $5.45B, a reduction from previous estimates. However, there’s a silver lining with the adjusted gross margin, which has been nudged upwards to a range of 75.3% to 76.3%. Full-year adjusted earnings are looking promising, too, with expectations falling between $1.49 and $1.53 per share, beating the earlier estimate of $1.47.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The second quarter wasn’t all doom and gloom either, as Fortinet earned an adjusted $0.38 per share on $1.29B in revenue, defying analyst predictions of $0.34 per share. But looking to the future, there are storm clouds on the horizon. The company’s Q3 sales forecast is set at $1.32B to $1.38B, with the mid-point falling short of what analysts were hoping for.

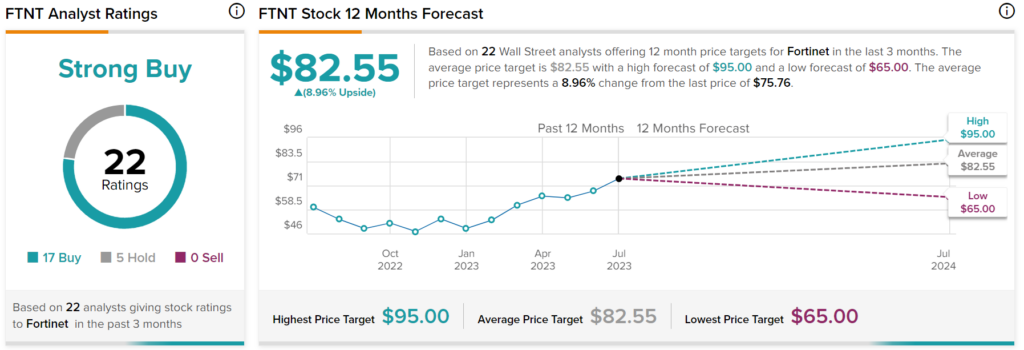

Turning to Wall Street, analysts have a Strong Buy consensus rating on FTNT stock based on 17 Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic above.