Ford (F) has a distinct plan to attain its goal of producing as many as two million electric vehicles annually. The strategy involves importing EV battery packs from China and sourcing battery materials directly from mining companies. The company is in the race to catch up to EV market leader Tesla (TSLA).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Ford shares rose more than 2.1% to $13 on July 21. The stock has declined about 40% year-to-date.

Secured Battery Supply for 600,000 EVs Per Year

Ford aims to produce 600,000 EVs a year by late 2023. It has secured enough battery supply commitments to achieve that level of production. The battery suppliers that Ford has lined up for its EV program include China’s battery maker, CATL.

By 2026, the automaker aims to produce more than two million EVs per year. It has so far secured supply commitments representing 70% of the battery capacity it would need to attain that level of output.

Apart from CATL, the other major EV battery suppliers Ford is working with include South Korea’s SK Innovation and LG Energy Solution. Ford is also sourcing battery materials directly from mining companies such as Rio Tinto (RTNTF), Vale (VALE), BHP Group (BHP), and China’s Huayou Cobalt.

The Market for EVs to Expand Exponentially

Ford sees the global EV market expanding by 90% annually through 2026. The company’s focus now is to boost production to meet that strong demand. Ford plans to invest $50 billion in its EV program through 2026. Ford can lean on its thriving conventional auto business to fund its EV future.

“Ford’s new electric vehicle lineup has generated huge enthusiasm and demand, and now we are putting the industrial system in place to scale quickly,” said Ford CEO Jim Farley.

Wall Street Is Cautiously Optimistic about Ford

The Street is cautiously optimistic about Ford with a Moderate Buy consensus rating, based on six Buys, 11 Holds, and one Sell. The average Ford price forecast of $16.74 implies 29% upside potential to current levels.

Bloggers are Highly Bullish on Ford’s Stock

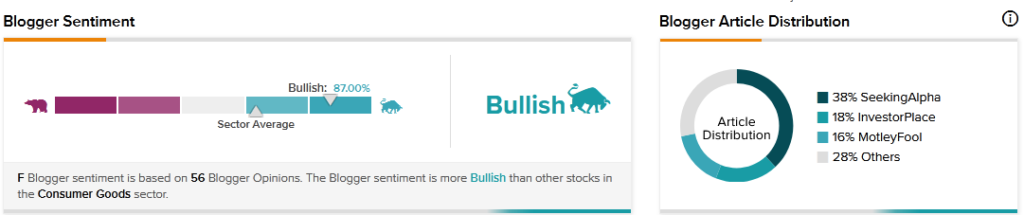

TipRanks data shows that financial blogger opinions are 87% Bullish on Ford, compared to a sector average of 63%.

Key Takeaway for Investors

Ford has captured only about 8% of the U.S. EV market, showing it has a long way to go to catch up to Tesla which controls more than 60% of the market. However, Ford is taking the right steps in arranging battery supplies for its EV production because limited manufacturing capacity currently remains EV makers’ top challenge.

Read full Disclosure.