Automobile bigwig Ford Motor Company (NYSE: F) recently reported stronger-than-expected results for the second quarter ended June 30, 2022. Both revenue and earnings surpassed the consensus estimates.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the strong results, shares of the company gained 6.4% to close at $14.03 in yesterday’s extended trade.

Revenue, Earnings Accelerate

Ford reported quarterly revenues of $40.2 billion which reflects a growth of 50.2% from the year-ago quarter. The figure also outpaced the consensus estimate of $36.87 billion. The primary driver of this impressive growth was the 57.1% year-over-year uptick seen in the company’s core automotive revenues to $37.9 billion.

The company’s earnings per share (EPS) for the quarter came in at $0.68 per share, up a whopping 423.1% from the prior year. Further, the figure surpassed the consensus estimate of $0.45 per share.

A Look at the Operating Metrics

Ford’s adjusted EBIT (Earnings Before Interest and Taxes) and adjusted EBIT margin improved from the previous year. The company’s adjusted EBIT now stands at $3.7 billion, compared to $1.1 billion in the year-ago quarter. Adjusted EBIT margin has improved to 9.3% from 3.9% in the previous year.

Meanwhile, the company’s adjusted ROIC improved from 10.3% in the prior year to 11.6%.

In terms of its Electric Vehicle (EV) plans, the company announced a series of agreements last week. The company proclaimed that these agreements would help it reach its targeted annual run rate of producing 600,000 EVs by late 2023.

Management’s Commentary

CEO of Ford, Jim Farley said, “We’re moving with purpose and speed into the most promising period for growth in Ford’s history – to innovate and deliver great products and connected services, raise quality and lower costs. We’re giving customers great experiences and value, improving our profitability and making Ford the next-generation transportation leader.”

Wall Street’s Take

Overall, the Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on six Buys, 11 Holds, and one Sell. The F average price target of $16.63 implies the stock has upside potential of 26.1% from current levels. Shares have declined 4.8% over the past year.

Investors Remain Optimistic About Ford Stock

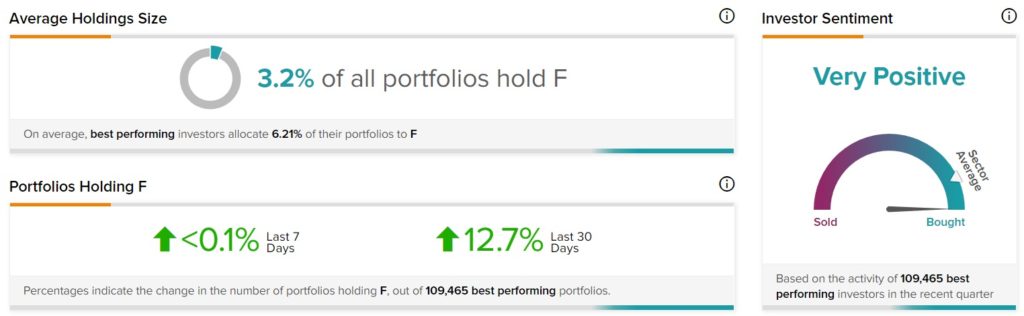

TipRanks’ Stock Investors tool shows that top investors currently have a Very Positive stance on F. Further, 12.7% of the top portfolios tracked by TipRanks, increased their exposure to F stock over the past 30 days.

Key Takeaways

Ford’s results for the second quarter have been impressive. With strong demand for its traditional internal-combustion vehicles and prudent financial management, the company remains on strong footing. Furthermore, the company should benefit from its expanding presence in the EV space.

However, global supply chain issues and an impending recession could impact its demand in the near term.

Read full Disclosure