It might seem like a strange dichotomy to hear that legacy automaker Ford (F) is ramping up a deal with a Chinese battery maker, even as it recently cut ties with SK On. But the deal with Contemporary Amperex Technology Co. Ltd. (CTATF) is a whole different matter. This deal will give Ford an extra edge in an area not really related to cars: grid storage. This branching out gave Ford a little extra edge in the market, and sent shares up fractionally in Wednesday afternoon’s trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The deal between Ford and Contemporary Amperex gives Ford access to lithium iron phosphate (LFP) technology. That in turn gives Ford the opening to build large-scale batteries in much the same way that Tesla (TSLA) is doing it. Given that Tesla recently inked a deal in Scotland to offer such services, this could be a deal that comes at a good time for Ford.

Making batteries using Chinese technology has been something of a controversial measure so far. An attempt to build a plant in Virginia that turned to Chinese technology was shut down, and a similar plant in Michigan only managed to go through after some pushback from lawmakers. But thanks to some excellent timing, Ford now has a competitive advantage, able to use the Chinese technology without restriction or loss of tax credits, reports note.

The Impact of Policies

Normally, Ford efforts produce results that can be useful in future marketing. But a content creator named Charles recently found himself on the bad side of such policies. And this will represent a serious problem for Ford marketing going forward. Charles recently purchased an $80,000 pickup truck. And Charles found the truck had some electrical issues that prompted a return to the dealership for repair.

Reasonable enough so far, but then, Charles asked about a loaner car or a rental because his recently-purchased truck was being repaired. Charles was rebuffed at the dealership due to his age; he was 22, and the dealership’s policies required he be 25. The fact that he had just spent several thousand dollars on a truck seemed to cut little ice with the dealership. While some believed that Charles was making much ado about nothing, Charles—and some like him—believed that his purchase should have allowed him some leeway in policy.

Is Ford Stock a Good Buy Right Now?

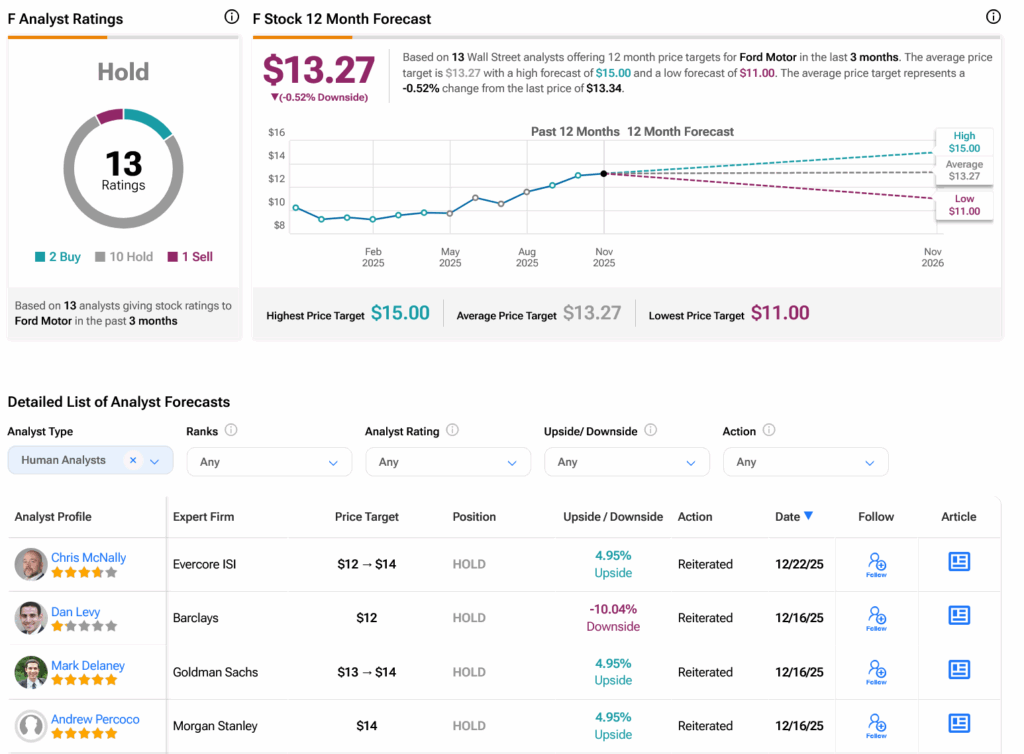

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on two Buys, 10 Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 31.98% rally in its share price over the past year, the average F price target of $13.27 per share implies 0.52% downside risk.