Ford (F) reported its strongest annual performance in six years, successfully navigating a cooling electric vehicle market by shifting toward more accessible options. While many manufacturers faced headwinds, Ford expanded its market share to 13.2% by catering to “bargain hunters” through its diverse range of powertrain choices.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The logic behind this growth lies in a two-pronged approach: dominating the hybrid market and capturing value-conscious buyers.

Ford Experiences Record-Breaking Hybrid Demand

Hybrid vehicles became the primary engine of growth for Ford in 2025. Sales in this segment surged nearly 22%, reaching a record 228,072 units. The F-150 Hybrid maintained its crown as America’s top-selling full-size hybrid pickup, proving that even traditional truck buyers are looking for better fuel efficiency without giving up capability.

The Maverick Leads the Value Charge

The Ford Maverick, marketed as America’s most affordable pickup, played a critical role in attracting new customers. Maverick sales jumped 18.2% to a record 155,051 units. Ford executives noted that nearly 60% of Maverick buyers are new to the brand, as the truck’s entry-level price point fills a gap left by competitors who have moved toward more expensive, luxury-focused models.

Despite the shift toward smaller trucks, the heavy-hitting F-Series remained America’s best-selling vehicle for the 44th consecutive year. Total F-Series deliveries grew 8.3% to over 828,000 trucks. This reliable volume provided the financial foundation for Ford to manage a $19.5 billion write-down in its electric vehicle division as it prepares to launch more “extended-range” hybrids in 2026.

Is Ford a Buy, Sell, or Hold?

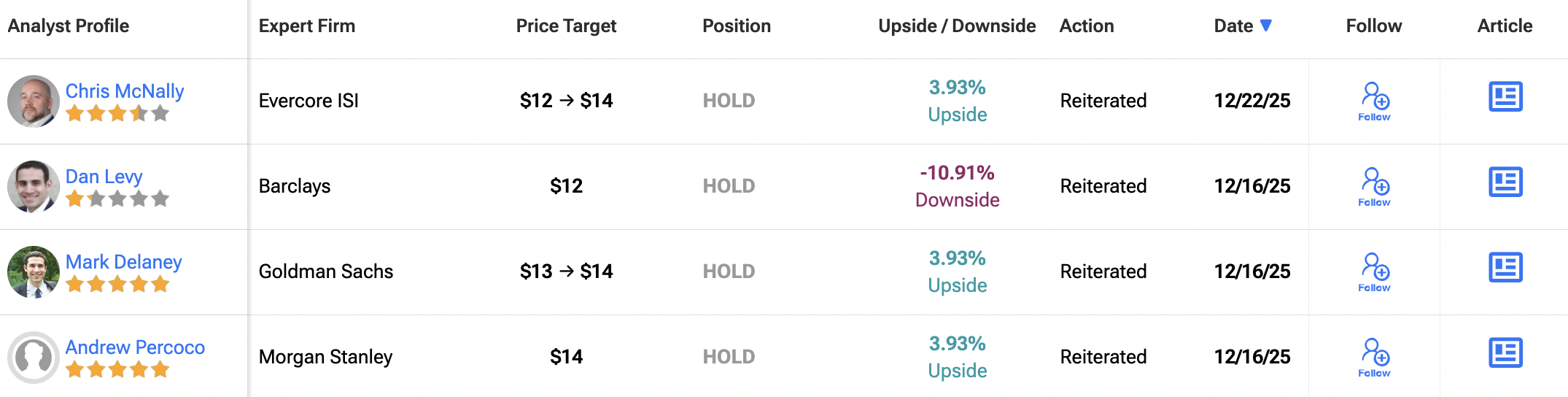

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on two Buys, 10 Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 35.8% rally in its share price over the past year, the average 12-month F price target of $13.27 per share implies 1.5% downside risk.