I find myself hard-pressed, at times, to believe how often legacy automaker Ford (F) can issue recalls on its products. In fact, another one just showed up, this time covering nearly a quarter of a million vehicles. And even investors look like they have had it with Ford; shares are down nearly 1.5% in Friday afternoon’s trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

This time, the recall targets Lincoln Aviators and Ford Explorers made between 2020 and 2021, the worst parts of the pandemic. That encompasses 240,510 such vehicles, and the focus is on seat belt anchor bolts. More specifically, the bolts may be improperly secured, which means that, in some cases, the whole housing could come undone, and that might be one of the last things anyone would want to see in a wreck.

The fix is rather simple; once again, Ford owners will need to return to their dealership of choice, where dealers will inspect the bolts. Should they be found to be part of the problem, the bolts and related components will be replaced. There will likely be no charge for this, except for the time you lose fixing Ford’s mistakes for them. Again.

Bronco Sport Discounts Continue

And good news for anyone paralyzed with indecision over the sheer cost of a car these days; the Ford Bronco’s new discount packages are still in play, and will continue to be so for the near term future, if nothing else. The 2024 Ford Bronco sport can still be had with a discount of $2,750 off, as well as “low-interest financing.”

Plus, there are lease deals involved for anyone who would rather go that route. There is $2,000 in “conquest cash” still available for those who owned or leased a Jeep, as well as for those who owned or leased a General Motors (GM) vehicle. Neither trade-ins nor lease terminations are required, either. However, the 2025 Ford Bronco Sport does not have any incentives on it. At least, not yet; that could change the farther into the new market year we get.

Is Ford Stock a Good Buy Right Now?

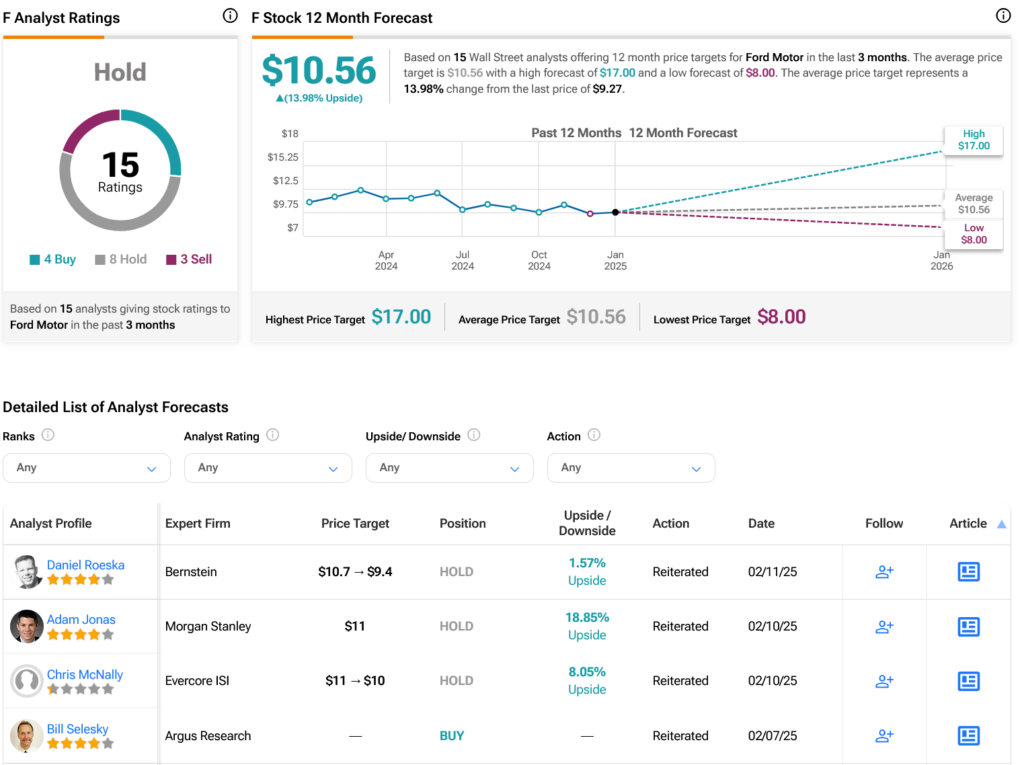

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on four Buys, eight Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 17.81% loss in its share price over the past year, the average F price target of $10.56 per share implies 13.98% upside potential.