Legacy automaker Ford Motor Co. (F) actually had a better October than you might have seen coming. Data for the month reveals that overall sales in the U.S. jumped 15%. What went into those numbers is catching attention as well, and Ford shares were up nearly 1.5% in Monday afternoon’s trading.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Trucks and hybrids. These were the two major sales leaders for Ford, which sold a total of 172,756 vehicles in October, and actually managed to take back some previously lost market share. It helped that Ford had a great month to compare itself to, as back in October 2023, Ford was dealing with a United Auto Workers strike.

While trucks and hybrids led the way, Ford found an unexpected bit of bad news in the mix: electric vehicle sales were down. Those sales dropped 8.3% against earlier numbers, thanks in large part to Ford Lightning F-150 sales declining. A further hit came when Ford announced it would shutter the Rouge Electric Vehicle Center, where the Lightning F-150 is produced, starting in a few weeks.

Recalls and Investigations

Meanwhile, Ford found itself in a sort of good news / bad news situation as it faced down a recall. Fully 6,212 Mustang vehicles are getting a recall notice over an instrument panel that may not light up. This should be fixed by a software update accomplished at any dealership, and notices will go out accordingly.

Better news came from the National Highway Traffic Safety Administration (NHTSA), though, who revealed that it was concluding an investigation into Ford vehicle engine failures. Engine replacements and extended warranties were sufficient inducement for the NHTSA to call the investigation closed. The investigation had traced the problem back to intake valves on certain engine types, which made Ford’s planned mitigation steps sufficient.

Is Ford Stock a Good Buy?

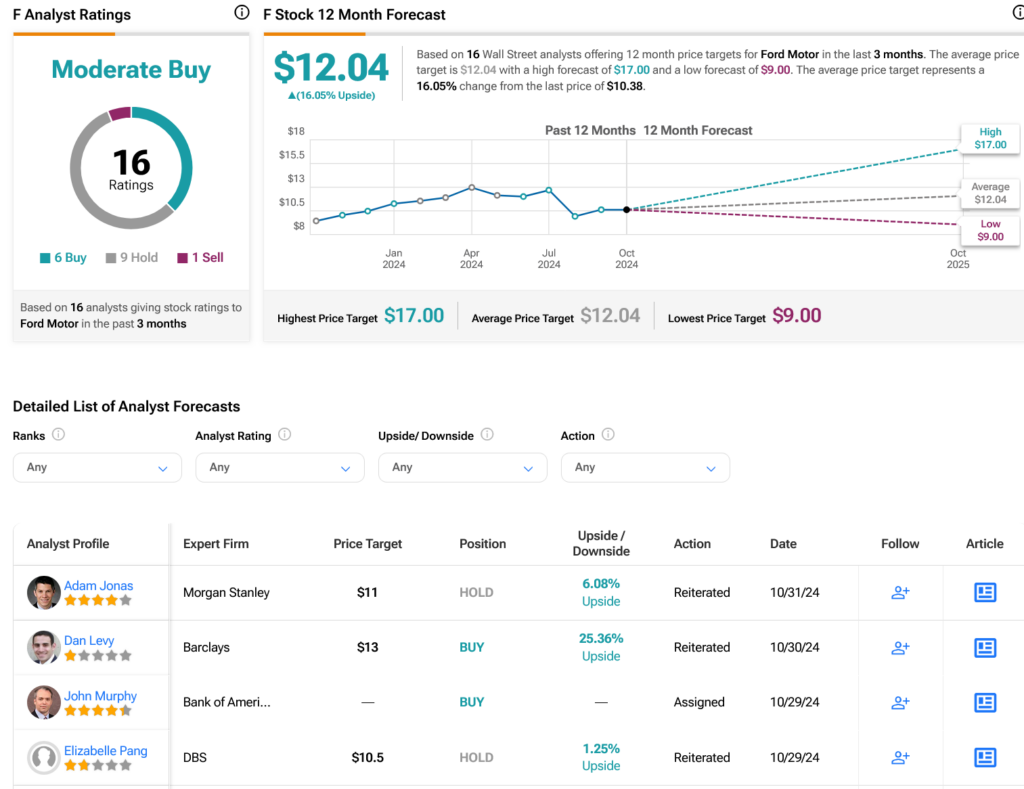

Turning to Wall Street, analysts have a Moderate Buy consensus rating on F stock based on six Buys, nine Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 6.14% rally in its share price over the past year, the average F price target of $12.04 per share implies 16.05% upside potential.