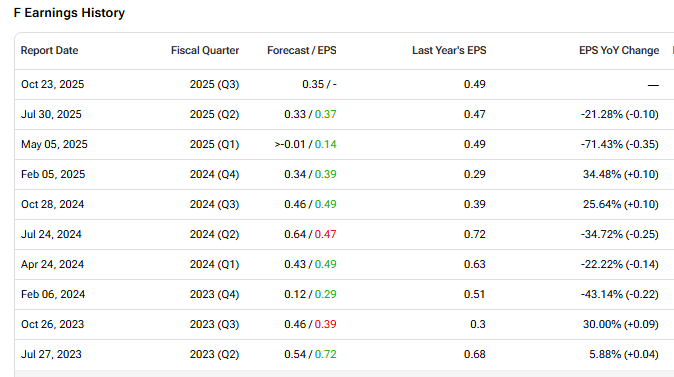

Ford Motor (F) is set to report its third-quarter 2025 results on October 23, after market close. The stock has gained about 15.6% year-to-date, driven by strong hybrid vehicle sales, steady demand for pickups and SUVs, and tighter cost control. Meanwhile, TipRanks’ AI stock analysis has assigned a Neutral rating on Ford stock with a price target of $12.50, reflecting a 0.48% downside potential. For Q3, Wall Street projects EPS of $0.35, down 29% year-over-year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, revenue is expected to increase 2% to $47.05 billion. It is important to note that Ford has a decent track record with earnings, having exceeded EPS estimates in seven of the past nine quarters.

Top Analyst Sees More Upside for Ford Ahead of Q3 Print

Ahead of the Q3 print, Jefferies analyst Philippe Houchois upgraded Ford stock from Underperform to Hold and raised the price target to $12 from $9. Houchois said Ford could gain billions from easier U.S. rules on emissions. The company may not provide 2026 guidance until next year, but it is expected to outline plans for an improved vehicle mix and adjustments to its EV strategy in the fourth quarter.

He also expects smaller EV losses, as Ford shifts more of its EV business to Europe, where costs are lower, and cuts spending on its new vehicle platform set for 2027.

Houchois noted that Ford is the most compliant U.S. automaker on emission rules. It has avoided fines and often earns credits. About 43% of Ford’s U.S. sales come from pickups and SUVs, which make up most of its profit. With relaxed limits on higher-emission models like the Raptor and ST-Line, Ford could offset tariffs and boost earnings next year.

Options Traders Anticipate a 6.11% Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 6.11% move in either direction.

Is Ford Stock a Good Buy Right Now?

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on two Buys, nine Holds, and two Sells assigned in the past three months, as indicated by the graphic below. The average F price target of $11.40 per share implies 8.29% downside risk.