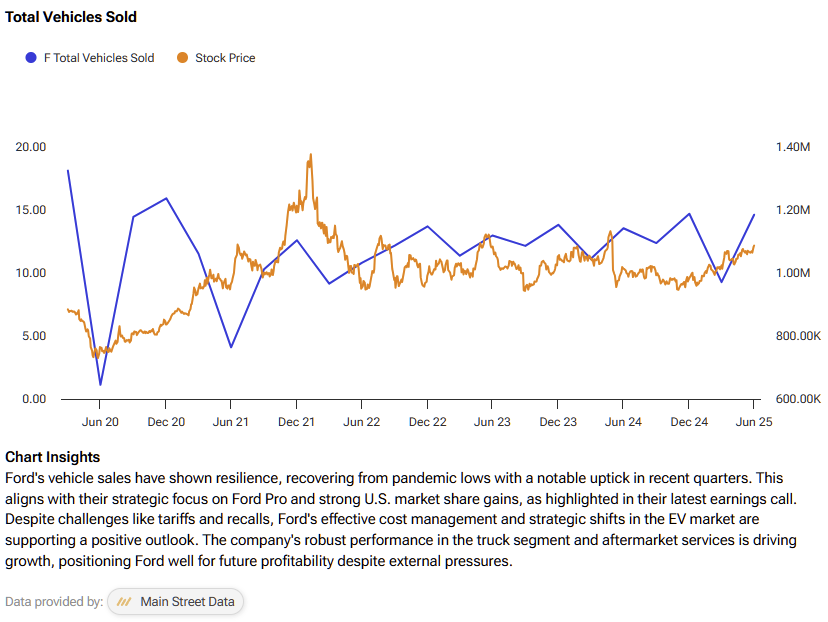

Legacy auto giant Ford Motor Co. (F) has faced criticism over the past decade for its slow pivot to electric vehicles (EVs) while pure-play EV rivals surged ahead. Now, however, the company appears to have crafted a more balanced strategy—one that emphasizes profitability alongside electrification.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

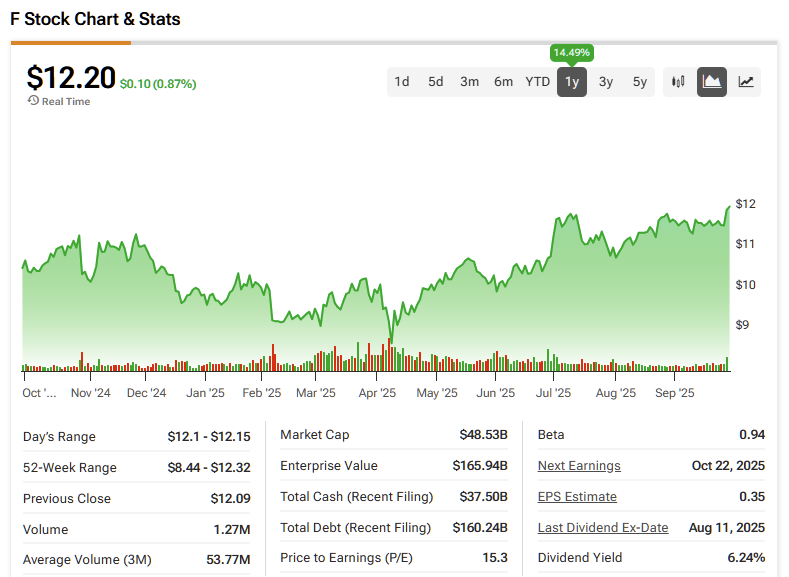

Even with shares trading near 52-week highs after a strong rally, Ford still looks attractively valued at a forward P/E of just 10.3x. I remain Bullish on the stock, as Ford’s disciplined approach positions it to emerge as a profitable, long-term leader in the evolving EV landscape.

Why Ford’s Reallocation to Ford Pro Strengthens its Bull Case

My bullish stance on Ford is supported by recent changes in Ford’s capital allocation framework, which aim to prioritize profitability over growth at any cost. During the automaker’s latest Q2 earnings call, CEO Jim Farley highlighted how the company has reallocated capital from some future EV programs to the highly profitable Ford Pro segment, thereby boosting the company’s earnings growth potential in the foreseeable future while continuing to make strategic investments in the EV business.

A closer evaluation of the profitability of Ford’s key business segments suggests reallocating capital to Ford Pro makes sense. In Q2, the Ford Blue segment reported EBIT of $2.3 billion at a margin of 12.3%, contributing the lion’s share to the company-wide adjusted EBIT.

Ford Blue segment reported EBIT of just $661 million at a margin of 2.6%, while the Model-E segment, which accounts for Ford’s EV business, reported an EBIT loss of $1.3 billion at a margin of (56.4%). As a legacy auto manufacturer, the success of Ford’s business transition efforts to embrace EVs hinges on its ability to generate sufficient cash flows to support the loss-making EV business. Considering this, the company’s capital allocation strategy seems impressive.

Strategic Focus on Hybrid Vehicles is a Winning Formula

I am also encouraged by how Ford, without committing fully to EVs like some of its closest rivals, is focused on striking a balance between hybrid and pure electric vehicles. Hybrids typically sell for a higher market price compared to ICEs and are sold at a profit, as evidenced by positive EBIT in the Ford Blue segment. Hybrid vehicles, while catering to the demand for new-age vehicles, can also contribute positively to earnings, which helps in offsetting some of the losses in the EV division.

I believe Ford’s strategy bodes well for consumer market trends as well. Since many legacy automakers are aggressively investing in BEVs, there seems to be an opportunity for Ford to capture market share in the hybrid vehicle segment. The company is already offering some of its most popular vehicle models as hybrid vehicles, including the F-150 and Maverick. This has given consumers an option to choose hybrid vehicles until low-cost BEVs are widely available across all vehicle models. This differentiated strategy should help Ford remain profitable and generate significant cash flows until its Model-E segment turns profitable.

Low-Cost EVs Could Open a Mass Market Opportunity

Amid the focus on growing the profitability of the core business, Ford is aggressively investing in EVs as well. A catalyst that could drive the profitability of the Model-E segment higher is the launch of a low-cost EV. According to Cox Automotive, as of August, the average transaction price for a new EV in the U.S. is ~$57,000. With a median household income of ~$83,000, the average American is not well-positioned to purchase an EV at this price.

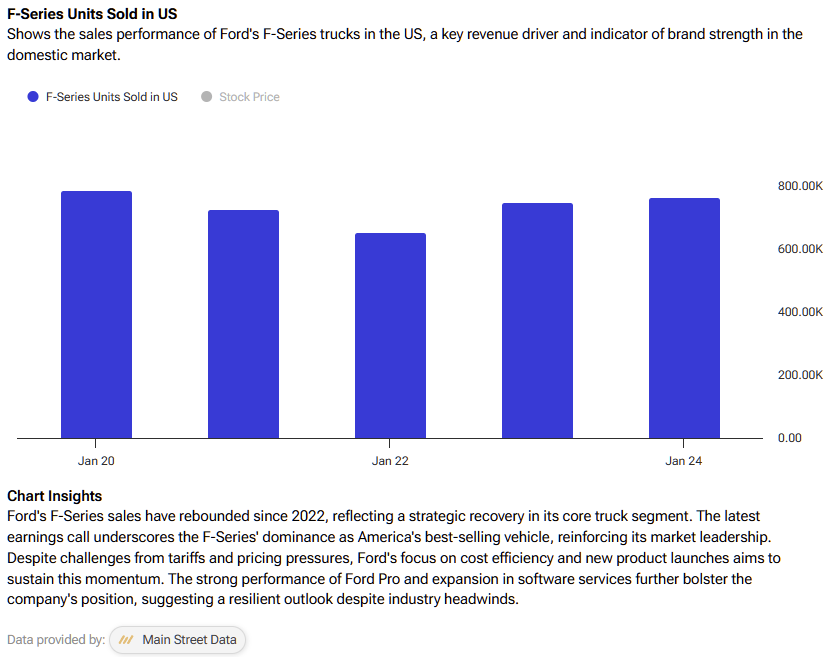

This has created an opening for automakers to grab market share with a low-cost EV. However, given Americans’ love for trucks and SUVs (7 out of 10 best-selling vehicles in the U.S. in 2024 were SUVs or trucks), it has been challenging for automakers to capitalize on this market opportunity, as building larger EVs incurs substantial costs. Meanwhile, Ford’s F-Series truck sales have rebounded from their 2022 lows, now selling nearly 800,000 trucks per year in the U.S.

Ford, in what could be a turning point for its Model-E division, launched a low-cost EV platform in August, promising to bring a $30,000 midsize EV pickup truck to the market as soon as 2027. This price point should help Ford capture a meaningful share of the EV market as it caters to the average American.

According to a recent PwC study, the high entry price point is one of the leading reasons behind the lackluster EV adoption in the U.S. compared to other regions such as Europe and China. Ford, with the launch of its low-cost EV platform, appears well-positioned to capitalize on this opportunity.

Is Ford a Buy, Sell, or Hold?

According to the ratings of 13 Wall Street analysts, Ford stock carries a Hold consensus rating based on two Buy, eight Hold, and three Sell ratings over the past three months. Ford’s average stock price target is $10.68, implying a ~12% downside over the next 12 months.

While analysts currently flag downside risk, I believe upward revisions are likely as Ford executes on its revamped capital allocation strategy—balancing disciplined EV investments with near-term profitability. On valuation, Ford stands out as far more compelling than pure-play EV peers.

Tesla (TSLA), for example, trades at a lofty forward P/E of 260x, compared to Ford’s modest 10.3x. Over the long run, as Ford advances its EV roadmap and demonstrates profitable growth, I expect the market to reward the company with a meaningful valuation re-rating.

Ford Pro Powers EV Future with Cash Flow

Ford is pursuing its EV ambitions with a disciplined focus on profitability. By channeling capital into the highly profitable Ford Pro segment, the company is creating the cash flow needed to fund future EV investments internally—a positive signal for investors. With shares still trading at an attractive valuation, Ford appears well-positioned to deliver strong long-term returns for shareholders.