The Federal Reserve’s Federal Open Market Committee (FOMC) met today to discuss how to handle the U.S. economy. Results from that meeting have the central bank deciding to keep interest rates unchanged from current levels. That means rates remain between 4.25% and 4.5%.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The Fed turns to the strong economy as its reason for avoiding an interest rate cut at this meeting. It points to a stabilized unemployment rate and “solid” labor market conditions despite elevated inflation. Inflation has remained above the Fed’s desired 2%, which is what spurred prior interest rate increases. Without inflation falling, there’s no reason to cut interest rates.

When Will Interest Rates Drop?

Investors didn’t get much information from the Fed about upcoming interest rates. Instead, the central bank remained vague with its comments about how it will react to economic changes. That includes saying it will “carefully assess incoming data, the evolving outlook, and the balance of risks.”

While investors expected the Fed to keep interest rates at current levels, there’s still hope cuts will come in 2025. This would follow a series of interest rate cuts in 2024 that dropped them by a full percentage point.

How to Play Elevated Interest Rates

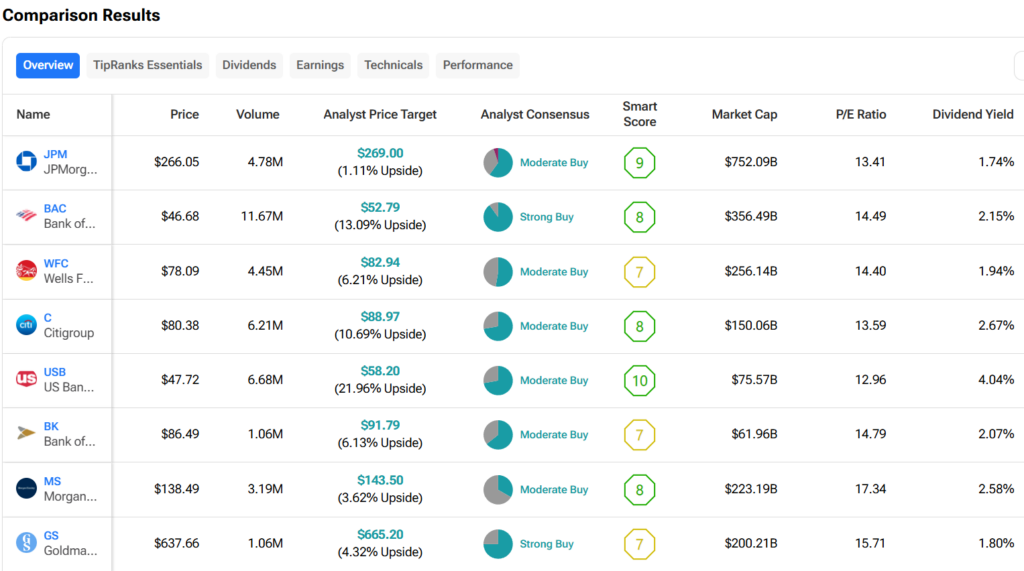

As interest rates remain elevated, investors will want to avoid growth stocks that are largely affected by them. Instead, they might consider taking stakes in bank stocks, which benefit from increased rates. Turning to the TipRanks’ stock comparison tool Bank of America (BAC) is a solid choice with its Strong Buy rating and 13.09% upside potential.

However, there are plenty of other financial stocks worth considering. Analysts are largely bullish on the banking sector right now with all of them in the comparison tool sporting at least a Moderate Buy rating. They all also have positive upside potential.