Shares of cloud contact center software solutions provider Five9 (NASDAQ:FIVN) are rising upward today after the company delivered better-than-anticipated first-quarter numbers.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue rose 20% year-over-year to $218.4 million, outperforming estimates by $10.4 million. EPS at $0.41 too came in ahead of expectations by $0.17. The company continues to witness growth in its enterprise vertical with LTM subscription revenue rising 31% over the prior year period.

Additionally, FIVN is also witnessing growth in international markets with LTM international revenue surging 48% year-over-year.

Looking ahead, for the full-year 2023, FIVN expects revenue to land between $906 million and $909 million. Net income is anticipated between $1.73 and $1.77. For Q2 2023, the company sees revenue hovering between $213.5 million and $214.5 million alongside EPS between $0.38 and $0.40.

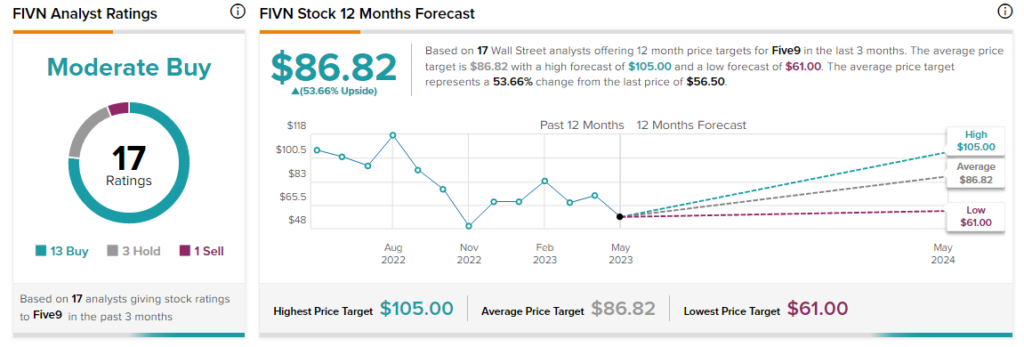

Overall, the Street has a $86.82 consensus price target on FIVN pointing to a 53.7% potential upside in the stock.

Read full Disclosure