The artificial intelligence boom is not slowing down and may still be in its early stages, according to five-star Bank of America (BAC) analyst Vivek Arya. While some investors are worried that valuations have become rich, Arya argues that the industry is only at the midpoint of a transformation that could last a decade. Furthermore, he sees Nvidia (NVDA) and Broadcom (AVGO) as the main leaders of this shift and believes that today’s skepticism is similar to the doubts seen in past technology cycles that ultimately proved to be too conservative.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

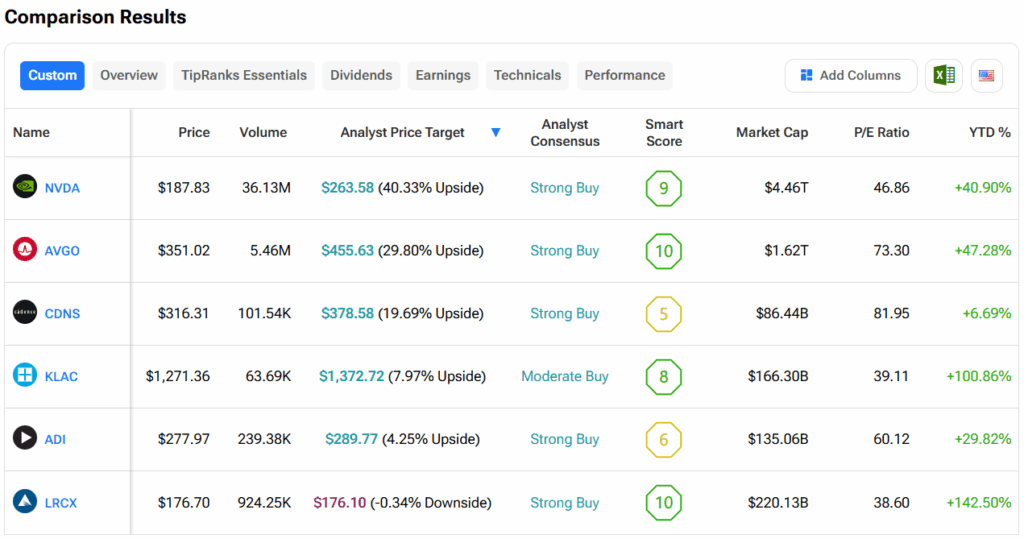

As a result, Arya forecasted that global semiconductor sales will rise by about 30% year-over-year and exceed $1 trillion annually by 2026. In addition, he said that his preferred investments are companies with strong competitive advantages, which he identifies as those with high margins. Therefore, alongside Nvidia and Broadcom, he named Lam Research (LRCX), KLA (KLAC), Analog Devices (ADI), and Cadence Design Systems (CDNS) as his top large-cap semiconductor picks.

How Big is the AI Data Center Market?

Bank of America estimates that the total addressable market for AI data center systems could surpass $1.2 trillion by 2030. This equates to a 38% annual growth rate, with AI accelerators alone representing a $900 billion opportunity. Still, the market remains cautious due to the massive costs involved, as a single large data center can require more than $60 billion in capital spending. Nevertheless, Arya remains confident and argues that Big Tech must invest to defend its core businesses.

Which Chip Stock Is the Better Buy?

Turning to Wall Street, out of the six chip stocks mentioned above, analysts think that Nvidia stock has the most room to run. In fact, Nvidia’s average price target of $263.58 per share implies more than 40% upside potential.