Shares of Five Below (NASDAQ:FIVE) sank in after-hours trading after reporting fourth-quarter earnings that didn’t meet expectations. The discount retailer posted a 2.8% increase in comparable sales, falling short of analyst predictions. In addition, earnings per share of $3.65 missed analysts’ consensus estimate of $3.78.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The CEO highlighted that while strong sales positively impacted profitability, unexpected shrink (loss of inventory) pushed earnings to the lower end of their guidance. As a result, the company is taking measures to reduce shrinkage.

For the upcoming fiscal year, the retailer anticipates comparable sales growth ranging from 0% to 3%, below the 2.2% consensus, and forecasts an EPS between $5.71 and $6.22. For reference, analysts were expecting an EPS of $6.48.

Is FIVE Stock a Buy?

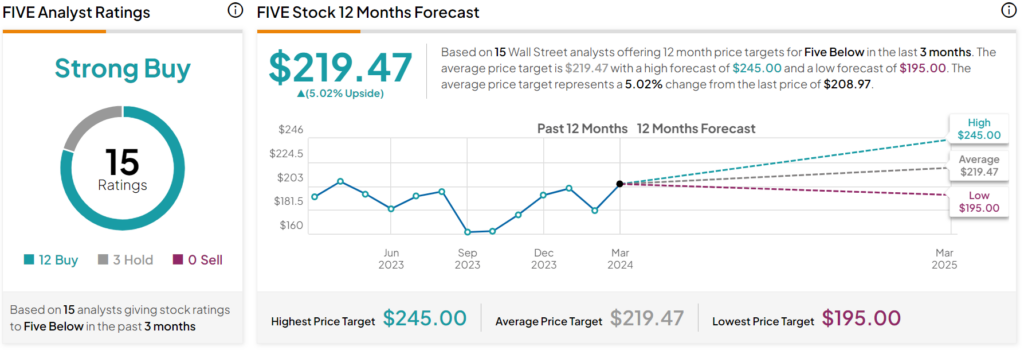

Turning to Wall Street, analysts have a Strong Buy consensus rating on FIVE stock based on 12 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 4.7% increase in its share price over the past year, the average FIVE price target of $219.47 per share implies 5% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.