Fiserv (FI) shares came under pressure after the company’s third-quarter results fell short of Wall Street expectations, prompting several analysts to downgrade ratings and slash their price targets. The fintech company’s disappointing Q3 performance and cautious guidance have shaken investor confidence and sparked concerns about its near-term growth outlook. FI stock is down more than 4% as of this writing, extending its sharp 40% plunge on Wednesday following the release of its disappointing Q3 earnings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Several Analysts Weigh In on FI Stock

Following the results, four-star-rated analyst Harshita Rawat at Bernstein downgraded her rating on FI stock from Buy to Hold, while trimming her price target from $205 to $80. She described the magnitude of the Q3 miss as “hard to explain” and a “180-degree turn under the new management.” Rawat added that she now has reduced confidence in the company’s visibility into its own business operations.

Likewise, analyst Charles Nabhan at Stephens downgraded to Hold and reduced the price target by 50% to $80. Nabhan said that while the company’s baseline has been “appropriately reset,” he doesn’t expect the stock to re-rate until the second half of 2026, when growth acceleration may become clearer. Stephens added that although recent management and board changes show a “commitment to change,” it will likely take several quarters for Fiserv to regain market confidence in its strategy.

At the same time, J.P. Morgan’s Tien Tsin Huang cut his price target from $155 to $85 but kept his Buy rating on FI. The four-star-rated analyst expected the company’s Q3 report to be a “clearing event,” but said the quarter “felt more like a necessary washout for Fiserv to cleanse itself, return to its roots, and be a high-quality compounder.” Meanwhile, he believes that yesterday’s selloff likely already accounts for the earnings revisions and lower valuation. Nonetheless, Huang added that Fiserv’s new, more realistic targets could help the company deliver clearer and more consistent results going forward.

Is Fiserv a Good Stock to Buy?

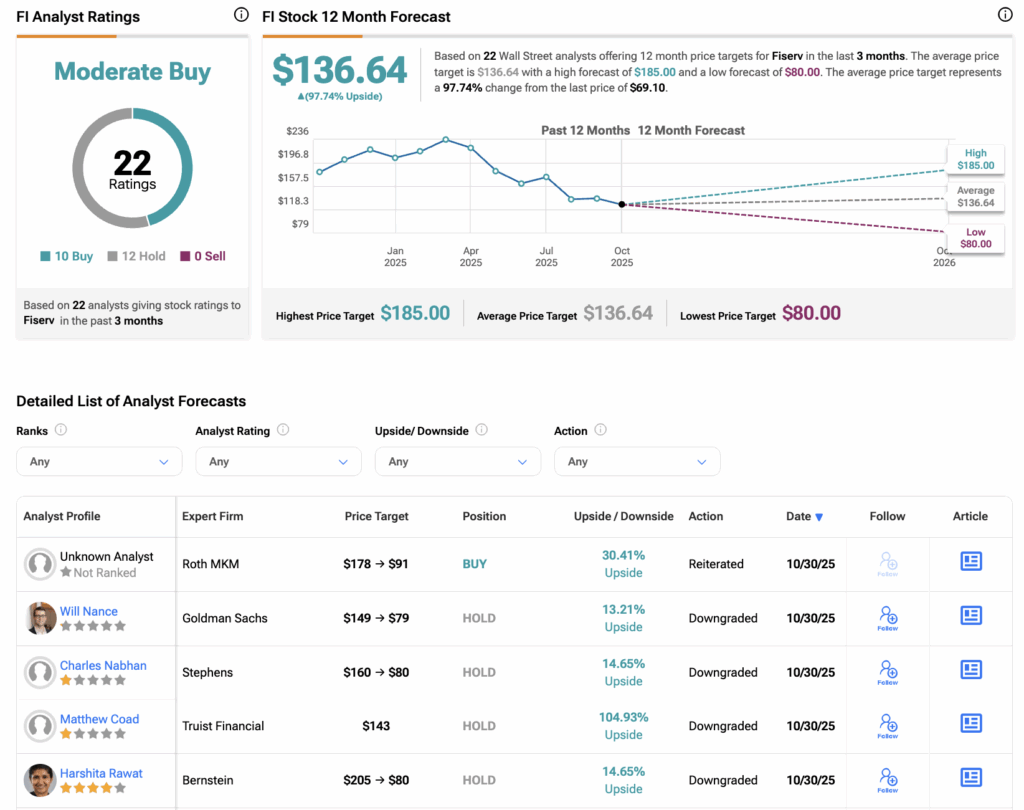

According to TipRanks, FI stock has a consensus Moderate Buy rating among 22 Wall Street analysts. That rating is based on 10 Buys and 12 Holds assigned in the last three months. The average Fiserv stock price target of $136.64 implies an upside of 97.74% from current levels.

Year-to-date, FI stock has declined by 67%.