Financial services companies Fiserv (FI) and PayPal (PYPL) announced on Monday that they’re working together to make their stablecoins—FIUSD and PYUSD—compatible with each other. This will help people and businesses move money both inside the U.S. and across borders. By combining Fiserv’s banking and payment tools with PayPal’s global presence in digital payments, the companies hope to make stablecoins and programmable payments more widely used around the world.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The two companies also plan to find the best ways to use their stablecoins in real payment situations, such as sending money to other countries, paying businesses, and processing payouts. In addition to the PayPal partnership, Fiserv is teaming up with Circle Internet Group (CRCL) to bring stablecoin-based tools to banks and merchants. Circle’s USDC platform will be connected with Fiserv’s digital banking system to give financial companies access to digital dollar technology.

Fiserv also confirmed plans to launch its own digital asset platform, including FIUSD, by the end of the year, which caused its stock to rise on Monday. This news comes just after the U.S. Senate passed a law to create official rules for stablecoins, which are digital tokens tied to assets like U.S. dollars or gold. These partnerships and new laws show that stablecoins are becoming a more accepted part of everyday finance.

Which Stock Is the Better Buy?

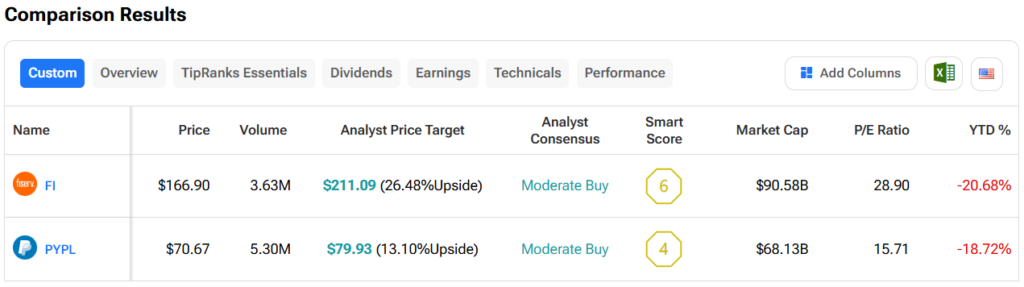

Turning to Wall Street, analysts think that FI stock has more room to run than PYPL. In fact, FI’s price target of $211.09 per share implies 26.5% upside versus PYPL’s 13.1%.