Fire & Flower Holdings (TSE: FAF) completed the acquisition of Pineapple Express Delivery Inc. (PED) on Tuesday.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

PED is a logistics technology company providing compliant and secure delivery services for controlled substances and regulated products, including transportation and delivery of medical and recreational products in Ontario, Manitoba, and Saskatchewan, and alcoholic products in Saskatchewan.

Pineapple Express Delivery was acquired through the settlement of C$5.15 million in debt and the issuance of 1.2 million shares of Fire & Flower.

Cannabis Industry’s First Comprehensive Cannabis Consumer Technology Platform

The acquisition of Pineapple Express Delivery provides Fire & Flower with the final piece to execute its strategy of delivering a comprehensive consumer technology platform to the cannabis industry.

PED is the largest player in the cannabis delivery space, making over 40,000 deliveries per month to recreational and medical cannabis customers across Canada.

Through this strategic acquisition, Fire & Flower has complemented its proprietary technology stack to deliver a seamless customer experience by combining its technology-driven retail network of over 100 stores across North America with this cannabis delivery and fulfillment service.

CEO Commentary

Fire & Flower CEO Trevor Fencott said, “Our Hifyre™ technology powered retail network has quickly driven greater high-margin revenue streams for Fire & Flower and the inclusion of Canada’s largest cannabis delivery and logistics services strategically supports our business model as we enter new markets utilizing our high-margin, scalable technology infrastructure. We look forward to rolling out our enhanced cannabis technology platform throughout Canada and eventually the U.S. with our strategic partner, Alimentation Couche-Tard, to demonstrate the unparalleled value of this model.”

Wall Street’s Take

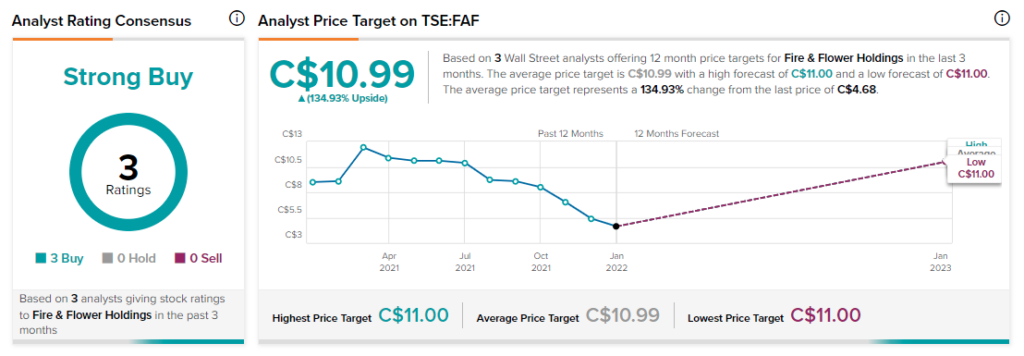

Last month, Echelon Wealth Partners analyst Andrew Semple kept a Buy rating on FAF with an C$11 price target. This implies 135% upside potential).

Overall, consensus among Wall Street analysts is a Strong Buy based on three Buys. The average Fire & Flower Holdings price target of C$10.99 implies upside potential of about 134.9% to current levels.

Download the TipRanks mobile app now

Related News:

Curaleaf Closes Bloom Dispensaries Acquisition

Organigram Q1 Revenue Rises 57%, Loss Shrinks

Tilray Q2 Net Revenue Rises 20%