Figma Inc. (FIG) burst onto the scene with one of this year’s hottest IPOs, launching at $33 on July 31 and skyrocketing to $115.50 in its first trading session. But the excitement didn’t last—shares have since been cut in half, with the post-earnings selloff highlighting just how high expectations had become. Earlier in today’s trading session, the stock was trading at a paltry $54 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The good cheer has turned to sour grapes, even though Figma hauled in ~$250 million in revenue with a 90% gross margin. Moreover, even with annual revenue up 41%, analysts argue Figma’s performance still falls short of justifying a Buy rating—and I agree with them. The stock has been drifting sideways for weeks, suggesting investors are waiting for clearer signals. For now, I see Figma as a Hold: the story is promising, but the valuation still leaves little room for error.

Markets Left Unimpressed by Figma’s First Report

Figma shares sank nearly 20% after the company reported its first-ever earnings as a public firm on September 3. Q2 results showed revenue up 41% year-over-year to $249.6 million, essentially matching expectations, while profitability landed slightly below consensus. The bigger concern was growth: revenue expansion slowed from 46% in Q1 to 41% in Q2. TipRanks readers can access the full earnings call audio, along with detailed call summaries and Figma’s upcoming earnings dates.

Guidance only added to investor unease. Management forecast Q3 revenue growth of 33% and full-year growth of 36.5%, both falling short of buy-side hopes for stronger momentum. With the stock already priced for acceleration, the tempered outlook triggered another wave of selling.

Even so, Figma’s fundamentals have shown resilience. The company continues to expand its enterprise footprint, with high-tier customer ARR rising 31% and those with top-tier customers, in the $100,000 category, increased 42% year-over-year. Net dollar retention for high-tier customers remained robust at 129%, supported by seat expansions, renewals, and favorable pricing.

Expansion Opportunity Beyond Core Design

Figma’s growth potential extends far beyond its flagship design platform. The company now operates in a digital design industry worth more than $36 billion annually, with a large base of 13 million monthly active users and 450,000 paying customers.

Recent product launches highlight the ambition to become a multi-product platform. FigJam (for whiteboarding), Dev Mode (for developers), and Slides (for presentations) have gained traction, while new offerings, including Figma Make, Draw, Sites, and Buzz, are in various stages of rollout. Although immediate financial contributions are likely limited, management is focused on broadening adoption over time.

Encouragingly, more than 80% of customers now use two or more Figma products, and two-thirds use three or more. This multi-product adoption metric is an important gauge of the company’s success and should help drive stickier relationships in the long run.

AI Could Strengthen, Not Threaten, Figma’s Long-Term Growth

Some investors worry that artificial intelligence (AI) could disrupt Figma by simplifying design workflows and reducing the need for specialized tools. However, I see AI as a potential tailwind. Figma is embedding AI capabilities across its suite, including Figma Make, FigJam AI, and the Dev Mode MCP server.

These features not only improve user experience but also position Figma to play a key role in designing and developing AI-native applications. The company has also begun open-sourcing AI components to accelerate adoption. Monetization of AI products is expected to start in fiscal 2026, which could provide a new revenue stream.

If successful, AI could make Figma even more integral to digital product development and collaboration, reinforcing its long-term relevance.

Figma Stock Looks Overvalued Despite Strong Growth Metrics

Despite the share price collapse since IPO, Figma still trades at lofty multiples. The stock’s GAAP P/E (TTM) stands at 106.4 versus a sector median of 29.0. Its price-to-sales ratio of 12.4 is also far above the industry median of 3.4.

Figma generated $62.5 million in operating cash flow during the quarter, representing a 25% margin. However, as management has reiterated its commitment to aggressive AI investment, margins will likely be pressured in the near term.

Based on my valuation models, including the five-year DCF growth exit, EV/Revenue multiples, and price-to-sales multiples, I calculate a fair value estimate of $35 per share. That represents roughly 35% downside from current levels. While growth prospects are undeniable, the stock still appears overpriced relative to its fundamentals.

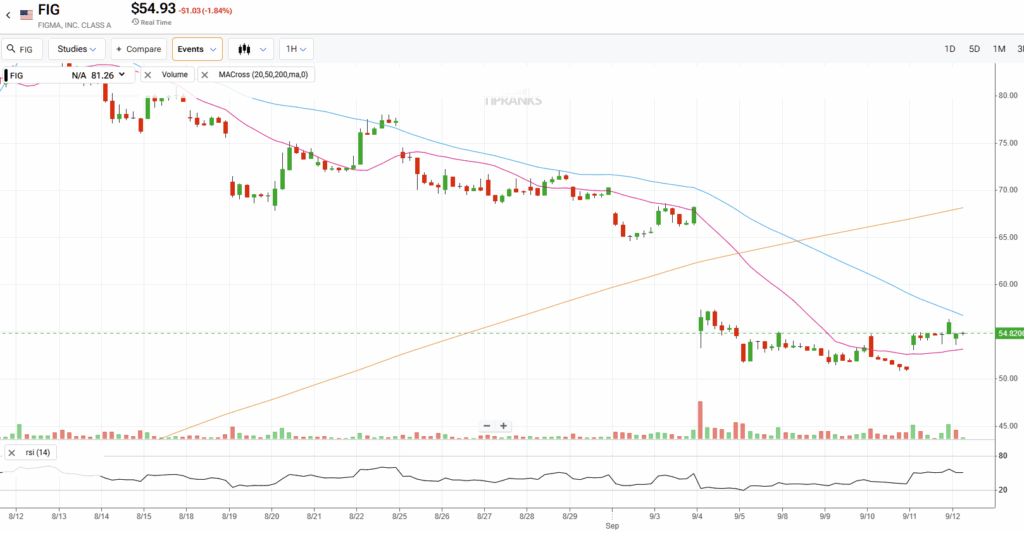

Mixed Technical Outlooks Add to Neutral Tone

From a technical standpoint, Figma presents a mixed setup. The MACD is currently at -10.39, hinting at potential bullish momentum. At the same time, the stock is trading near $51, well below its 20-day exponential moving average of 66.31—an indicator that leans bearish.

Is Figma a Buy?

According to TipRanks, Figma holds an average Hold rating from nine analysts, with two Buys, seven Holds, and no Sells. FIG’s average stock price target is $67.57, with a high forecast of $85 and a low forecast of $49, thereby implying approximately 24% upside potential over the next twelve months.

Strengths Tempered by Valuation

Figma has carved out a commanding position in the digital design space, fueled by rapid user growth, strong enterprise adoption, and a steadily expanding product suite. Its AI roadmap could unlock new growth levers, with monetization expected to begin in fiscal 2026.

However, and potentially a concern, even after losing more than half its value since the IPO, the stock still trades at a steep premium. With revenue growth slowing and heavy investment needs ahead, shares may remain range-bound in the near term. While I see meaningful long-term potential in Figma’s strategy, valuation risk tempers the outlook. For now, I maintain a Hold position on the stock.