Tesla, Inc. (NASDAQ:TSLA) investors have reasons to smile this holiday season, as they look back on the past half-year with healthy gains in their pockets. Those possessing faith in Elon Musk have additional reason for cheer, as the CEO’s massive (potential) payday should keep him fully engaged in the years ahead.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

No one would accuse Musk of lacking ambition, and many of those who have previously bet against his ability to deliver groundbreaking technology have often found themselves on the wrong side of a losing argument.

Whether he will be able to meet the ambitious benchmarks laid out in his compensation package – such as placing 1,000,000 robotaxis and 1,000,000 humanoid robots in circulation – tends to be the dividing line between the hopeful bulls and the worried bears.

One investor known by the pseudonym Agar Capital isn’t ready to throw in the towel regarding Tesla’s future prospects. However, this bear doesn’t see much hope in the near-term.

“I consider the upside/downside risk on Tesla, for the 6-12 month period to be highly skewed to the downside at current price levels,” explains the investor.

Agar further details that TSLA seems to be priced as if it is already well on its way to becoming a “dominant” AI and software company. Looking at the robotaxi and Optimus ventures, Agar wonders how much progress will show up on the company’s balance sheet in the coming year.

The answer, according to the investor, isn’t encouraging: “Very little,” posits Agar, who adds that Morgan Stanley (“famously optimistic regarding Tesla”) has a baseline forecast that calls for 1,000,000 robotaxis — but that will be in 2035.

The investor has a similar take when it comes to Optimus robots, where potential gains will only be enjoyed futher down the road.

“Currently, Optimus is merely a prototype and is nowhere near ready for mass production,” emphasizes Agar.

Moreover, some current intangible advantages could prove short-lived. Agar argues that as the only publicly-traded company controlled by Musk, Tesla benefits from having a “Musk premium.” However, if SpaceX ends up going public, investors would have another Musk-related address to invest in.

“Tesla is now a potential risk to stay away from rather than a possible opportunity to take advantage of,” concludes Agar Capital, who rates TSLA a Strong Sell. (To watch Agar Capital’s track record, click here)

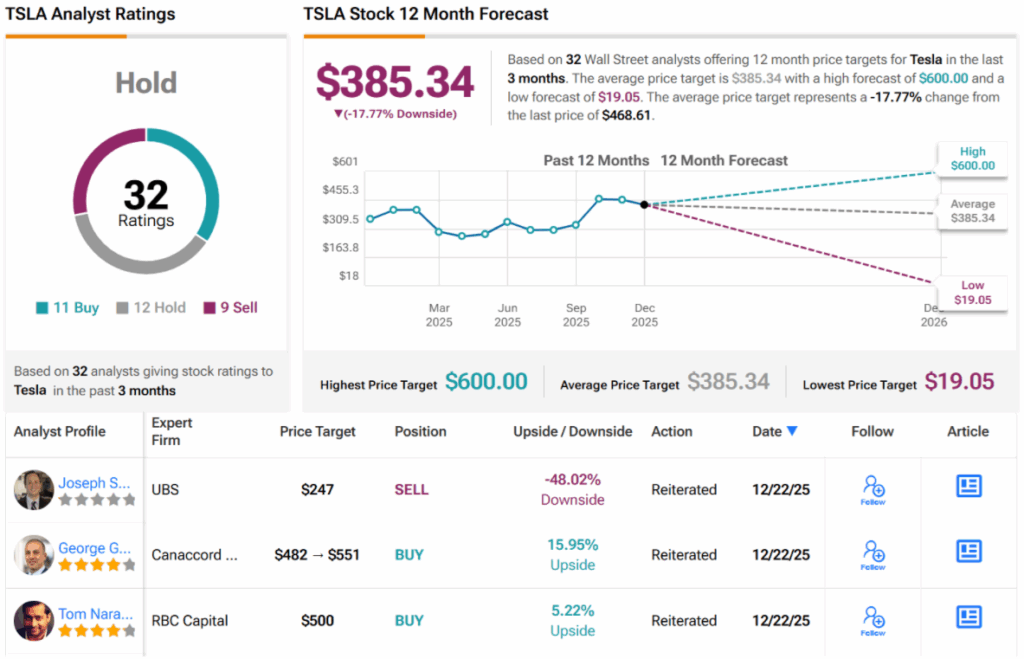

Tesla provokes a wide variety of opinions among Wall Street. With 11 Buys, 12 Holds, and 9 Sells, TSLA carries a consensus Hold (i.e., Neutral) rating. Its 12-month average price target of $385.34 implies a downside just shy of 18%. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.