Shares of Fever-Tree Drinks (LON: FEVR) plunged 8% Thursday after the company announced a business update for the year ending December 31, 2021.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The supplier of premier carbonated mixers will announce its preliminary results on March 16, 2022.

Fever-Tree Overtakes Schweppes

Fever-Tree expects to record full-year revenues of £311.1 million, up 23%. This reflects growth in all markets, with the best performances coming from the United States and Europe.

U.K. revenue grew 15% in 2021, ahead of the group’s expectations. In the U.S., Fever-Tree generated revenue of around £77.9m in 2021, a 33% year-over-year increase.

Fever-Tree became the top brand of ginger beer sold at retail in the United States. It ended the year as the top brand of tonic sold at retail in the United States, overtaking Schweppes.

The group warned that EBITDA margins had been affected by supply chain disruption and wider uncertainty in the second half. However, strong sales mean earnings for the full year should be in line with expectations.

CEO Commentary

Fever-Tree CEO Tim Warrillow said, “The Group continues to deliver impressive growth in every one of our key markets, however, I am of course mindful that short-term logistics challenges and cost pressures remain, along with On-Trade restrictions, albeit at a much lower level than this time last year. Despite this, Fever-Tree’s strong growth and track record against the competition, alongside supportive global trends, gives us confidence in our ability to capitalise on the substantial global opportunity.”

Wall Street’s Take

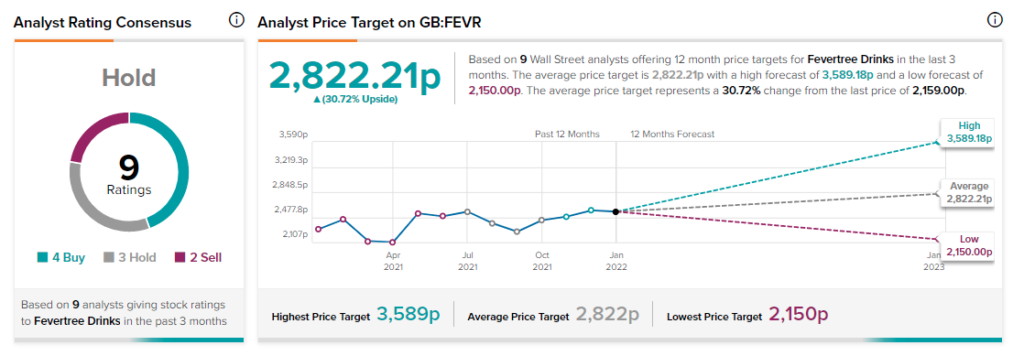

On January 26, Citi analyst Jemima Benstead kept a Hold rating and 2,300p price target. This implies 6.5% upside potential.

Overall, FEVR scores a Hold analyst consensus rating based on fours Buys, three Holds and two Sells. The average Fever-Tree Drinks price target of 2,822.21p implies 30.7% upside potential to current levels.

Download the TipRanks mobile app now

Related News:

The Restaurant Group Expects Higher Full-Year EBITDA

Goodfood Q1 Loss Widens; Shares Plunge

Emerge Hires Ocgrow Ventures CEO; Shares Pop