Shares of luxury automotive maker Ferrari (NYSE:RACE) are trending higher today on the back of the company’s robust fourth-quarter showing. Revenue rose 18.8% year-over-year to €1.39 billion, edging past estimates by €110 million.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

EPS at €1.21 too came in better than expectations by €0.05. During the year, total shipments rose by 18.5% to 13,221 units and industrial free cash flow landed at €758 million. Clearly, Ferrari is brushing past any macroeconomic woes and sees the present high demand continuing in 2023 as well.

The company is seeing buoyant shipment trends for the Ferrari Portofino M and the SF90 family as also for the 296 GTB and the 812 Competizione.

Looking ahead, for 2023, Ferrari is expecting a strong product mix and is undertaking price increases to offset the impact of inflation. For the year, Ferrari expects net revenue of €5.7 billion. EPS is anticipated to hover between €6 and €6.20.

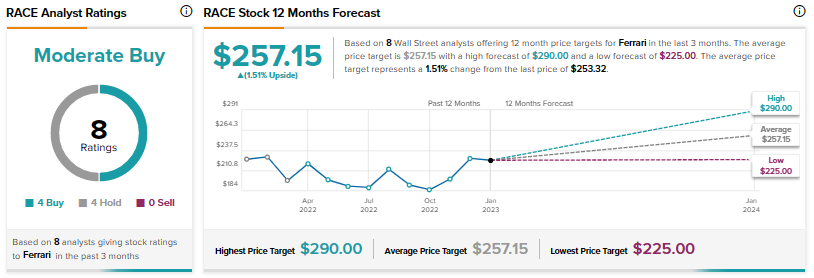

Overall, Wall Street has a consensus price target of $257.15 on RACE, implying the stock is fairly priced at the current level. That’s after an 18.8% rise in the company’s share price over the past six months.

Read full Disclosure