FedEx (FDX) surged to a new 52-week high on Tuesday due to rising optimism about the company’s turnaround plan and future earnings potential. The logistics giant recently delivered a strong earnings report and raised its full-year profit outlook, signaling that its sweeping cost-cutting and network overhaul efforts under CEO Raj Subramaniam are gaining traction.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

FDX stock has gained 26% in the past three months, fueled by cost-cutting progress, a shift toward business-to-business (B2B) services, and renewed investor confidence in its long-term prospects.

Jim Cramer Praises FedEx as a “Remarkable Company”

According to a report by Insider Monkey, CNBC’s Jim Cramer recently spotlighted FedEx on a recent episode of “Mad Money.” Cramer called it a “remarkable company,” praising both FedEx founder Fred Smith and the leadership of Subramaniam. Moreover, he advised investors to “stay long” and even “buy more” on any pullback.

“Right now, I see two of these CEOs orchestrating turnarounds, happening right under our noses… FedEx, which was built by the late Fred Smith, is a remarkable company that’s become ubiquitous with one of the greatest competitive modes I’ve ever seen,” Cramer said.

Also, he highlighted FedEx’s shift from a consumer-heavy model to a more resilient B2B strategy, especially in the pharmaceutical logistics segment, which he called “the biggest in the country.”

He also pointed to the company’s under-the-radar expansion into data center logistics as a potential growth engine.

Cramer noted that FedEx delivered these results despite macro headwinds such as tariffs, a slowing U.S. economy, and reduced trade with China. “All these things would have probably derailed the old FedEx. Not so Raj’s,” he said.

Is FDX Stock a Good Buy?

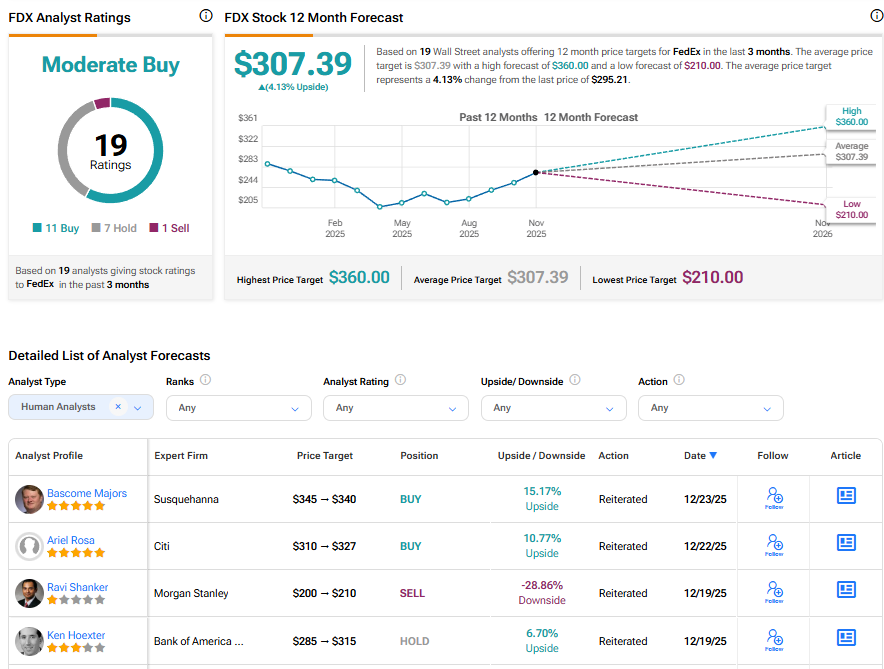

Turning to Wall Street, analysts have a Moderate Buy consensus rating on FDX stock based on 11 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Further, the average FDX price target of $307.39 per share implies 4.13% upside potential.