The Federal Reserve’s latest survey of economists, strategists and fund managers has found growing concerns about “market risks.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The 38 survey respondents, who include leading market observers, expressed worries about the lack of economic data during the U.S. government shutdown, a potential artificial intelligence (AI) bubble, stubborn inflation, and whether politics will play a role in the U.S. Federal Reserve’s current and future decisions.

One survey respondent likened the current stock market set-up to “flying in a blizzard with a blindfold on and no backup instrumentation…” The survey findings are being released a day before the Fed is expected to lower interest rates by 25 basis points on Oct. 29. Markets also expect the U.S. central bank to cut interest rates at its next two meetings in December and January.

Uneasy Rate Cuts

The latest Fed survey also found that while 92% of respondents believe the Federal Reserve will cut interest rates at its October meeting, only 66% believe the central bank should lower rates, with more than 30% opposing any rate cut for the time being.

Richard Bernstein, a financial advisor, is quoted as saying: “Financial conditions are near historically easy, GDP is tracking 3.5-4%, financial assets are ripping, and inflation remains well above the Fed’s target. In more normal times, there is no way the Fed would be cutting rates.”

Additionally, nearly 80% of survey respondents say that stocks related to AI are extremely or somewhat overvalued right now.

Is the SPDR S&P 500 ETF Trust a Buy?

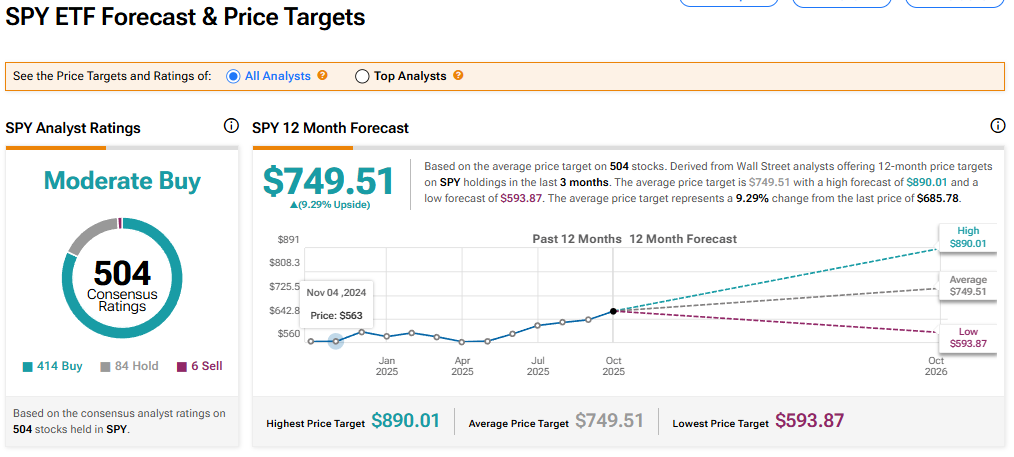

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 414 Buy, 84 Hold, and six Sell recommendations issued in the last three months. The average SPY price target of $749.51 implies 9.29% upside from current levels.