The S&P 500 (SPX) is heading toward the 7,000 mark, capping off a strong 2025. As of Friday, the index was up nearly 18% for the year, while the Nasdaq Composite rose 22%. Markets are set to finish December in the green, despite earlier weakness in tech stocks tied to AI spending.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This month could mark the eighth straight monthly gain for the S&P 500. That would be its longest win streak since 2017. Although trading volume is light during the holiday week, investors remain upbeat. The “Santa Claus Rally” period began on December 24 and runs through January 5. Historically, stocks rise during these seven days. Since 1950, the S&P 500 has averaged a 1.3% gain during this window, with a positive result nearly 80% of the time, according to LPL Financial (LPLA).

Tech Stocks Cool as Other Sectors Catch Up

While the full-year returns remain strong, tech shares have cooled since November. The S&P 500 tech sector is down more than 3% since early that month. At the same time, sectors such as financials, healthcare, transportation, and small caps have posted gains.

That shift suggests some investors are rotating into areas with more stable prices and lower expectations. Several analysts believe the broader market is now showing signs of balance after tech stocks led for much of the post-pandemic rally.

Freeport-McMoRan (FCX) was among the top gainers on Friday as silver (XAGUSD) rose to $79.45 per ounce. Gold (XAUUSD) prices also climbed 1.3% as demand for safe assets continued. A weaker dollar, soft bond yields, and supply constraints have supported the move in precious metals.

Fed Cuts, Trump Nomination Keep Market on Watch

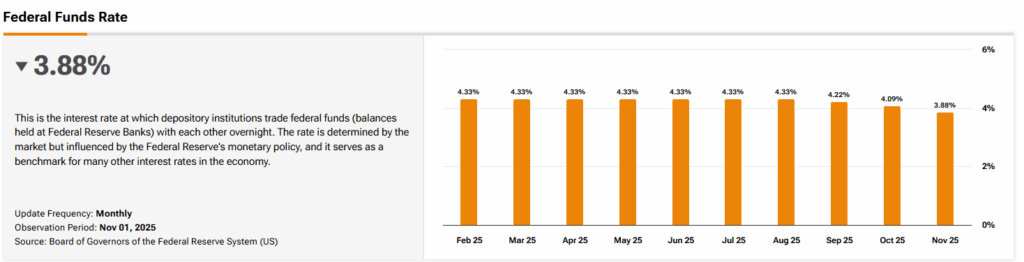

Markets are focused on the Federal Reserve’s next steps. The central bank has cut rates by 75 basis points over its past three meetings. The current target range sits at 3.50% to 3.75%. At the Fed’s December meeting, members voted to cut rates by 0.25%. However, the vote was split, and projections for next year varied.

Investors are awaiting the minutes from the meeting, due Tuesday, for more clues on the path of rate cuts in 2026. According to Glenmede Trust, the minutes may shed light on the extent of agreement within the Fed.

Another market factor is the expected change at the top of the Fed. Jerome Powell’s term as chair ends in May. President Donald Trump has not yet announced a replacement. Any news on that front could drive short-term market swings.

What to Watch Into Year-End

With just a few trading days left in 2025, analysts are watching for year-end adjustments by funds and large firms. These moves can add volatility when trading volumes are thin.

At the same time, optimism about the U.S. economy has increased. Investors are growing more confident that recent hurdles from rate shocks to political risks may ease in the new year.

While some sectors are still finding their footing, the overall market tone remains positive. If the S&P 500 clears 7,000, it would mark a symbolic close to a year where gains came not just from tech, but from a broader range of industries.