Shares of FedEx (FDX) sank in after-hours trading after the delivery services company reported earnings for its third quarter of Fiscal Year 2025 that was accompanied by a soft outlook. Earnings per share came in at $4.51, which missed analysts’ consensus estimate of $4.56 per share. However, sales increased by 2.3% year-over-year, with revenue hitting $22.2 billion. This beat analysts’ expectations of $21.87 billion but did not seem to be enough for investors.

FedEx CEO Raj Subramaniam said that despite facing significant challenges, including severe weather and a shorter holiday season, the company improved its profitability. Indeed, despite the miss, EPS was still higher than the $3.86 during the same time last year. As a result, Subramaniam praised his team for their hard work in transforming the business and delivering a better overall experience.

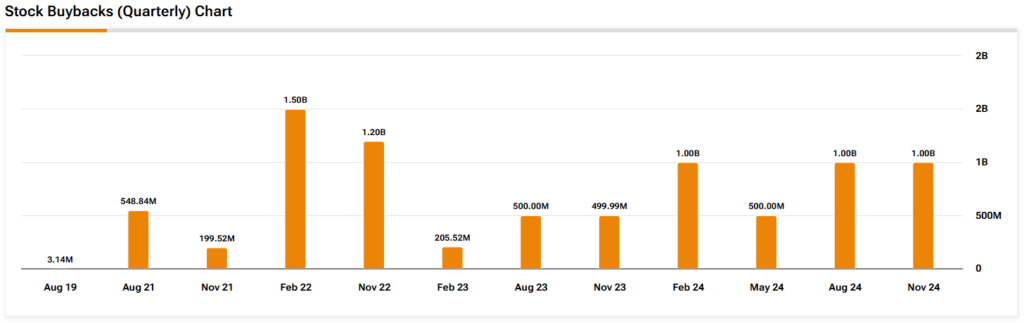

In addition, during the third quarter, FDX bought back $500 million worth of shares, therefore completing its $2.5 billion share repurchase plan for Fiscal Year 2025. The firm has regularly repurchased its shares in each of the most recent quarters (as demonstrated in the image below) and, overall, has $2.6 billion remaining under its buyback plan.

2025 Outlook

Looking forward, management now expects revenue growth in FY 2025 to be flat to slightly down year-over-year, compared to the prior forecast of approximately flat. Furthermore, adjusted earnings per share are anticipated to land between $18.00 and $18.60. For reference, analysts were expecting an adjusted EPS of $19.18.

As you can see, guidance was worse than expected, which, when combined with the current quarter’s EPS miss, led to a decline in the share price.

Is FedEx a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on FDX stock based on eight Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 5% decline in its share price over the past year, the average FDX price target of $297 per share implies 21% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.

Questions or Comments about the article? Write to editor@tipranks.com