Cloud computing services provider Fastly (NYSE:FSLY) plunged in pre-market trading after the company’s outlook disappointed investors. The company expects Q1 revenues in the range of $131 million to $135 million, with an adjusted loss of between -$0.09 and -$0.05 per share. Analysts were estimating $135.5 million in revenue and a loss of -$0.03 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company’s FY24 guidance calls for revenue to be between $580 million and $590 million compared to consensus estimates of $586 million. In addition, Fastly forecasts EPS to land between -$0.06 and breakeven. Analysts were estimating a loss of $0.03 per share in FY24.

In the fourth quarter, the company reported adjusted earnings of $0.01 per share compared to -$0.08 per share in the same period last year. This was better than analysts’ forecasts of -$0.03 per share.

Fastly clocked Q4 revenues of $137.8 million, a growth of 15% year-over-year but below consensus estimates of $139.8 million.

What is the Future of Fastly Stock?

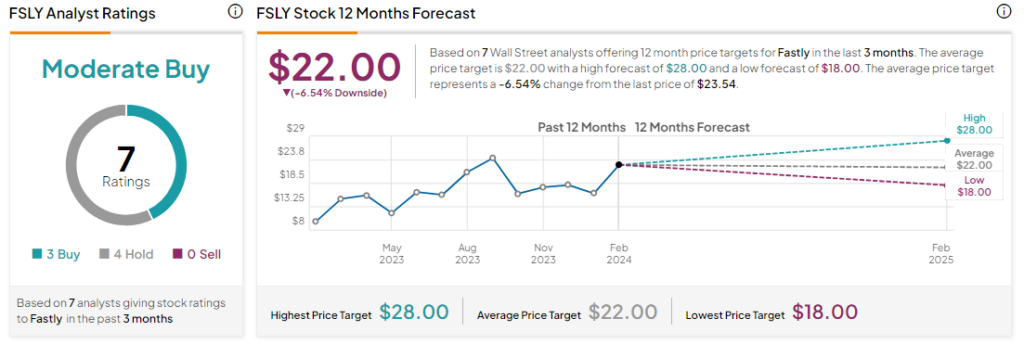

Analysts are cautiously optimistic about FSLY stock with a Moderate Buy consensus rating based on three Buys and four Holds. The average FSLY price target of $22 implies a downside potential of 6.5% at current levels. Investors have been optimistic about FSLY stock as it has surged by more than 65% over the past year.