Earlier today, news emerged that luxury retailer Farfetch (NYSE:FTCH) was potentially in line to go private. But that news turned out not to be the case, and investors panicked in the closing minutes of Wednesday’s trading session, cashing out and taking over 54% of Farfetch’s market cap with them.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

So what happened? Word came out from Richemont that it has no plans to lend any money to Farfetch or make any investment therein either. That took out one of the two key supports for any plans to take Farfetch private, with the other being Alibaba (NYSE:BABA). That was when things got even worse.

Farfetch also announced that it wasn’t going to reveal its third-quarter earnings as scheduled and made the delay about as inconclusive as possible, noting it would offer a market update in “due course.” Richemont did, however, not that it was “carefully” monitoring the situation, and in line with that, considering all possible options.

Is There Hope For Farfetch?

Perhaps worst of all for Farfetch were the reports that it fell to a record low of $1.03 per share during Wednesday’s trading, and a quick look at the share price suggests the record low is still up for grabs. As of this writing, it was down to $0.92 per share. It didn’t help that, back in August, Farfetch reported earnings results that were well below expectations and also made it clear that it was no longer a pandemic darling. The growing sales it saw during our brief age of lockdown and stimulus checks had largely dried up, and now, things aren’t looking good.

What is the Prediction for Farfetch Stock?

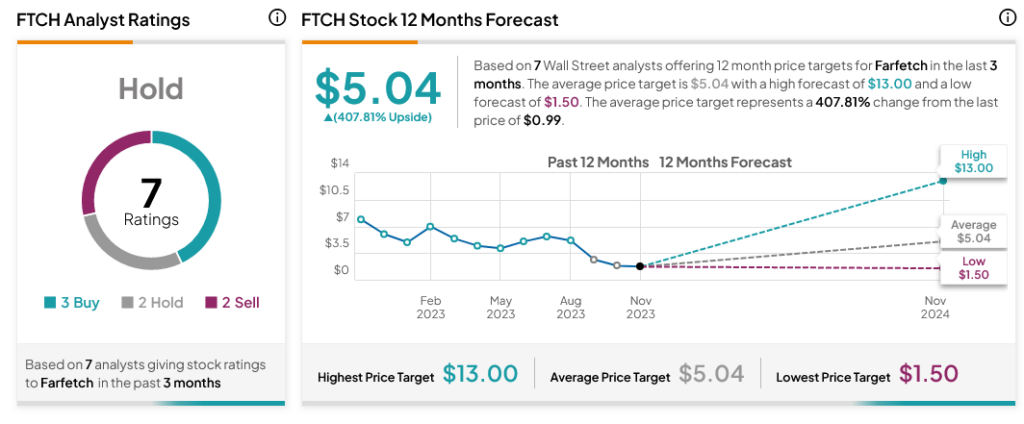

Turning to Wall Street, analysts have a Hold consensus rating on FTCH stock based on three Buys, two Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After an 88.24% loss in its share price over the past year, the average FTCH price target of $5.04 per share implies 407.81% upside potential.