Shares in U.S.-government-owned mortgage finance firms Fannie Mae (FNMA) and Freddie Mac (FMCC) went through the roof today as President Trump pondered taking them both public.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CASH Buyers

In a post on Truth Social, Trump said he was “giving very serious consideration” to the spin-off and would decide in the near future.

“Fannie Mae and Freddie Mac are doing very well, throwing off a lot of CASH, and the time would seem to be right,” Trump said. Indeed, Fannie Mae reported a net income of $3.7 billion for the first quarter of 2025 with $76 billion in liquidity provided to the housing market, facilitating approximately 287,000 home transactions, including 74,000 for first-time homebuyers.

He added that he would speak on the matter with Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and Federal Housing Finance Director William Pulte.

Their valuation as privatized entities has been estimated at $330 billion and the government’s stake has been valued at $250 billion. Their shares, which don’t trade on major exchanges, have surged more than 260% in the past year.

Private Shareholders

Fannie, formally known as the Federal National Mortgage Association, and Freddie, the Federal Home Loan Mortgage Corp., operate as for-profit firms with private shareholders.

They were created by Congress to expand the national home lending market by buying home loans from private lenders and repackaging them as mortgage-backed securities.

In early trading, Fannie shares were up 30% while Freddie shares were up 26%.

Fannie and Freddie suffered huge losses when the U.S. housing market collapsed during the subprime mortgage crisis in 2007-2008.

The proposed listing might face some barriers. Some housing analysts have rised concerns that removing government backing would drive up mortgage rates for homeowners.

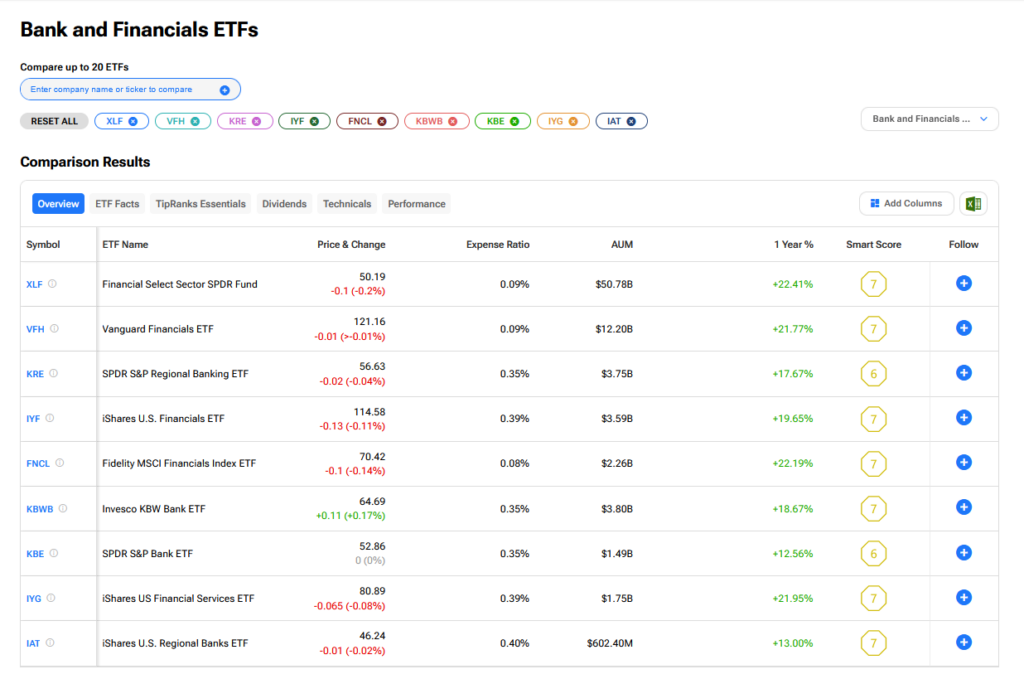

What are the Best Banking and Financial ETFs to Buy?

We have rounded up the best banking and financial ETFs to buy using our TipRanks comparison tool.