FalconX is expanding its reach into fund management. The crypto-trading firm said it will acquire 21Shares, one of the largest issuers of exchange-traded funds tied to digital assets. The move comes as competition intensifies to capture institutional money flowing into crypto products.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

What Is the Incentive Behind the Acquisition?

The combined company plans to develop new crypto funds focused on derivatives and structured products. Executives said the deal was financed through a mix of cash and equity, though financial terms were not disclosed.

Moreover, FalconX has grown quickly since its founding in 2018 by Raghu Yarlagadda. The company has processed more than $2 trillion in crypto trades for over 2,000 institutional clients. It raised $150 million in venture funding in 2022, valuing the firm at $8 billion. Yarlagadda said the company is now considering an initial public offering as its next step.

In addition, 21Shares brings significant scale and credibility to the deal. The firm manages more than $11 billion across 55 listed crypto exchange-traded products. It is best known for launching one of the first U.S. spot Bitcoin ETFs with Cathie Wood’s ARK Investment Management in 2024.

Rising Demand Drives New Crypto ETFs

The surge in spot Bitcoin ETFs led by BlackRock (IBIT) and Fidelity has sparked a rush among asset managers to launch similar products. Many are now expanding into funds that track smaller, higher-risk cryptocurrencies as regulatory clarity improves.

“Bitcoin flows are now happening through what we call traditional wrappers, and that’s a fundamental shift in market structure,” Yarlagadda said. He added that merging FalconX’s trading infrastructure with 21Shares’ fund expertise will help bring new products to market faster.

Meanwhile, regulators are opening the door for more innovation. In September, the Securities and Exchange Commission approved new listing standards that simplify the launch process for crypto ETFs. The updated rules shorten approval timelines and reduce administrative hurdles, creating room for faster product rollouts.

Crypto Deals Gain Speed Under Lighter Oversight

President Trump’s recent support for digital assets has accelerated deal-making across the industry. Companies are moving to secure partnerships and assets ahead of what they expect will be a friendlier regulatory environment.

Last week, Ripple acquired corporate treasury software provider GTreasury for $1 billion. On Tuesday, Coinbase Global (COIN) agreed to buy Echo, a blockchain capital-raising platform, in a $375 million deal, according to The Wall Street Journal.

Together, these deals reflect a maturing industry. FalconX’s purchase of 21Shares adds to that trend, linking trading infrastructure with fund management at a time when institutional interest in crypto is surging. For investors, it could signal another step toward bringing digital assets deeper into mainstream finance.

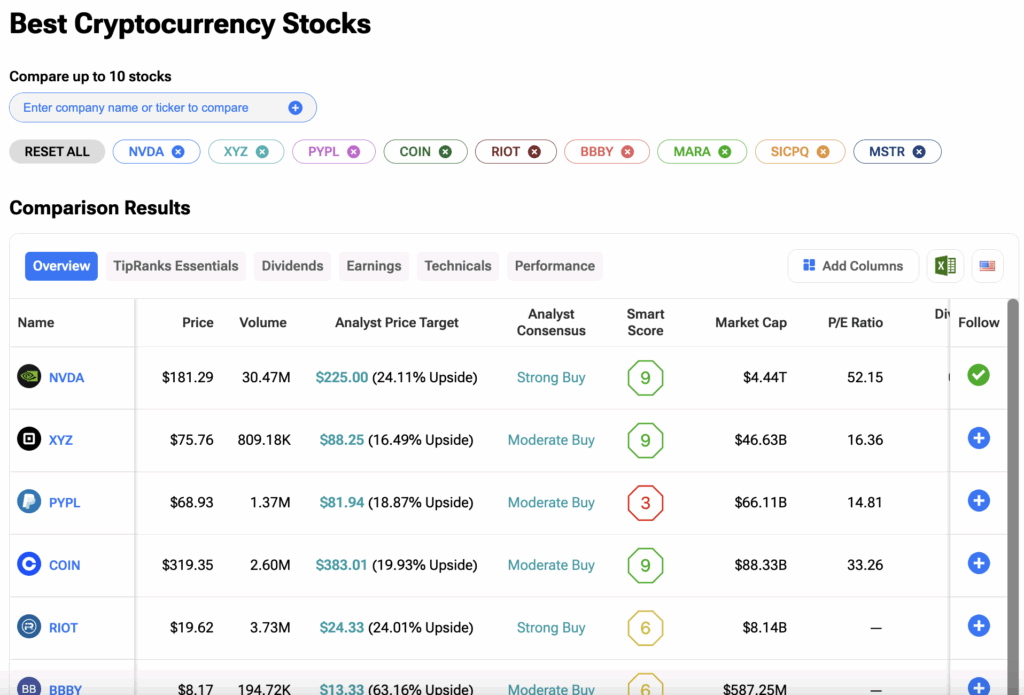

As crypto pushes further into the mainstream, companies with exposure to the sector could see their revenues climb. Of course, it depends on the business, but for investors, now’s a smart time to keep an eye on how their favourite crypto stocks are performing. Markets shift fast—and staying ahead means staying informed. You can compare top crypto-exposed stocks side-by-side using the TipRanks Crypto Stocks Comparison tool. Click on the image below to find out more.