Facebook’s parent company Meta Platforms (META) has seen explosive growth outside its core markets by the end of 2024. The surge highlights Meta’s success in expanding into new markets and diversifying its revenue streams beyond its traditional core regions. Additionally, the company has enhanced operational efficiency by significantly reducing its administrative expenses. Let’s examine some key data from Meta in 2024, highlighting its significant developments.

Meta’s Surge Beyond Core Markets

According to Main Street Data, Meta’s revenue from the rest of the world region has grown significantly from $5.27 billion in Q3 2024 to a remarkable $9.24 billion in Q4 2024. This marks a substantial growth rate of 75.33%, emphasizing the company’s success in expanding its global footprint. This rapid growth has propelled Meta’s rest of the world region from the fourth-largest to the third-largest revenue source, surpassing the Asia-Pacific region and signaling a shift in the company’s revenue structure.

Meta has tailored its advertising products to suit the unique needs of different markets. By offering customized solutions that cater to local businesses and advertisers, the company has been able to increase its ad revenue from these regions. Consequently, ad revenue growth was highest in the rest of the world region, rising by 27%, followed by Asia-Pacific and Europe at 23% and 22%, respectively.

Meta Achieves Operational Efficiency

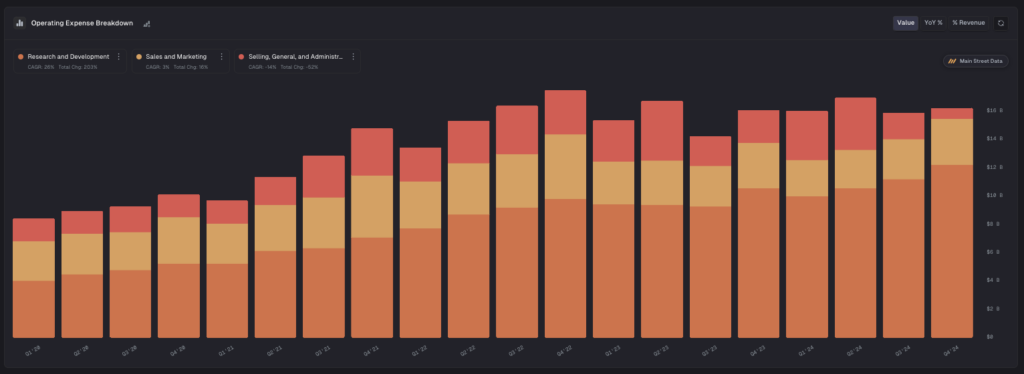

According to additional data from Main Street Data, Meta’s selling, general, and administrative (SG&A) expenses stood at $3.66 billion in Q2 2024. By Q4 2024, however, these expenses had dropped significantly to $761 million, marking a 79.21% reduction. Notably, the company’s general and administrative expenses in Q4 were positively impacted by $1.55 billion due to a decrease in the anticipated costs for ongoing legal proceedings.

Moreover, Meta reduced these expenses through cost-cutting initiatives, efficiency improvements, and operational streamlining. The company took steps to trim its workforce as part of the company’s broader strategy to enhance resource efficiency while continuing to make significant investments in research and development. Meanwhile, research and development accounted for the largest portion of Meta’s total operating expenses, with $12.2 billion out of $16.2 billion in Q4 2024.

Is META a Good Stock to Buy Now?

These strategic moves have not only boosted profitability but also enhanced investor confidence. META stock has gained over 17% in the last 12 months.

Turning to Wall Street, META stock has a consensus Strong Buy rating among 48 Wall Street analysts on TipRanks. That rating is based on 44 Buys, three Holds, and one Sell assigned in the last three months. The average META price target of $761.41 implies a 32.1% upside from current levels.