Shares of automaker Ford (F) sank in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2024 that included a soft outlook. Earnings per share came in at $0.49, which beat analysts’ consensus estimate of $0.46 per share. Sales increased by 5% year-over-year, with revenue hitting $46.2 billion. This also beat analysts’ expectations of $45.13 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This yearly revenue increase was mostly driven by Ford’s Pro Commercial Segment, which grew by 13% due to high demand for Super Duty trucks and Transit commercial vans. A fresh product lineup also helped the segment. Other business highlights included Ford Pro Intelligence subscriptions rising by 30% this quarter to almost 630,000. Ford’s 2,400 mobile service vehicles saw a 70% increase in repair orders due to strong demand for digital and remote services.

In addition, Ford Blue’s revenue climbed 3% to $26.2 billion in Q3. North American volume rose by 8%, thanks to new trucks and SUVs, which lifted Ford’s U.S. market share to 12.6%. Furthermore, global hybrid sales grew by 30% this quarter and are on track to reach 9% of Ford’s total mix by the end of the year. It is worth noting that Ford dominated 77% of the U.S. hybrid truck market.

Ford’s Guidance for FY 2024

Looking forward, management has provided the following guidance for FY 2024:

- Adjusted EBIT of $10 billion versus prior outlook of $10 billion to $12 billion

- Adjusted free cash flow of $7.5 billion to $8.5 billion, which is unchanged from the previous outlook

As we can see, the company’s adjusted EBIT outlook came in at the low end of its previous estimate, which disappointed investors and led to the after-hours move in the stock price. Interestingly, the biggest drag on EBIT comes from the company’s Model e segment, as it will likely see a loss of $5 billion.

What Is Ford’s Target Price?

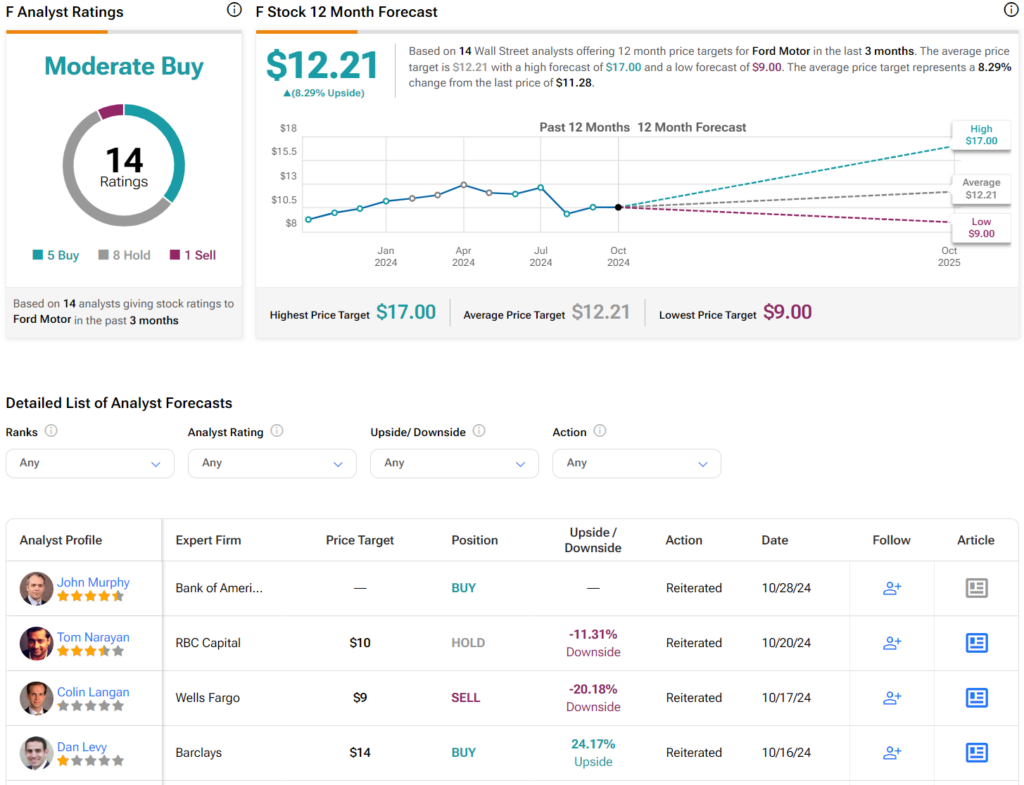

Turning to Wall Street, analysts have a Moderate consensus rating on Ford stock based on five Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 24% rally in its share price over the past year, the average Ford price target of $12.21 per share implies 8.3% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.