ExxonMobil (XOM), the biggest U.S. oil and gas producer, has continued to criticize the European Union’s new corporate sustainability law. CEO Darren Woods, who called the law “harmful,” has said that the legislation could force it to pull out of Europe, according to Reuters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The EU Corporate Sustainability Due Diligence Directive subjects energy companies to a 5% fine on their global revenue if they fail to address human rights and environmental concerns across their supply chain — both within and outside Europe.

The legislation entered into force in July last year and seeks to better protect human rights and attract more environmentally-conscious investors into the industry, according to the EU.

EU Law Faces Push Back

However, the legislation has drawn criticism from energy producers and from the U.S. and Qatar, which is a key gas supplier to the EU. Woods has previously called for the law to be quashed entirely.

On Monday, on the sidelines of the Abu Dhabi International Petroleum Exhibition and Conference in Abu Dhabi, United Arab Emirates, Woods told the outlet that enforcing the rules in markets across the world where ExxonMobil conducts its business makes it “impossible to stay there.”

Woods’s comment comes as the energy company last week reported its latest quarterly financial results, with profit falling about 12% year-over-year to $8.61 billion. The company’s net income was dragged by lower crude oil prices and higher costs.

U.S. Campaigns for More Oil Production

Meanwhile, the European Union earlier this year proposed changes to the law that would exempt more companies from the rules. However, these changes are still awaiting approval, expected around the end of the year.

In addition to arguing for a total withdrawal, Woods in September noted that he was in touch with President Donald Trump and members of his administration regarding the law. “We have slowly been pulling out of Europe,” Woods previously told Reuters.

Back home, the Trump administration has been scaling back the country’s climate protection rules, with Trump calling for increased domestic crude oil production, including through his famous “drill, baby, drill” outcry made earlier this year.

Is ExxonMobil a Buy, Sell, or Hold?

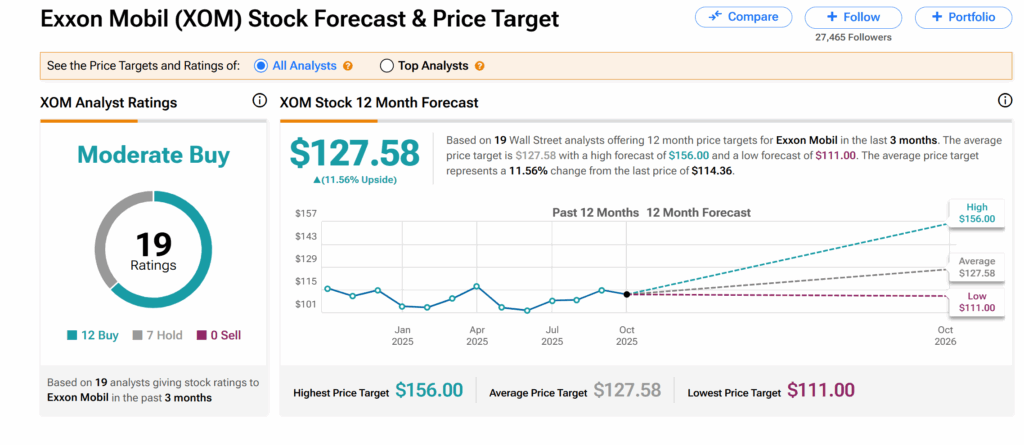

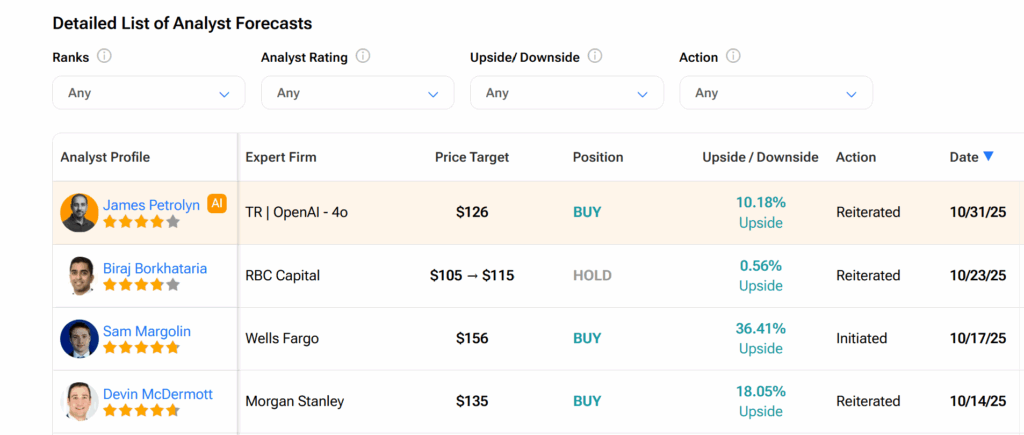

Across Wall Street, ExxonMobil’s shares currently have a Moderate Buy consensus rating, according to TipRanks data. This is based on 12 Buys and seven Holds issued by 19 analysts over the past three months.

Moreover, the average XOM price target of $127.58 indicates about 12% upside from the current level.