Shares of online travel company Expedia Group (NASDAQ:EXPE) are down nearly 14% at the time of writing today after its second-quarter revenue at $3.36 billion came in lower than expectations by $10 million. EPS at $2.89 though outperformed estimates by $0.54.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The company is witnessing strong travel demand with lodging gross bookings remaining at record levels at $19.2 billion during the quarter. Additionally, while B2B revenue rose 32% year-over-year, Expedia also witnessed a margin expansion of 1,730 basis points with a net income of $385 million (as compared to a net loss of $185 million in the year-ago period).

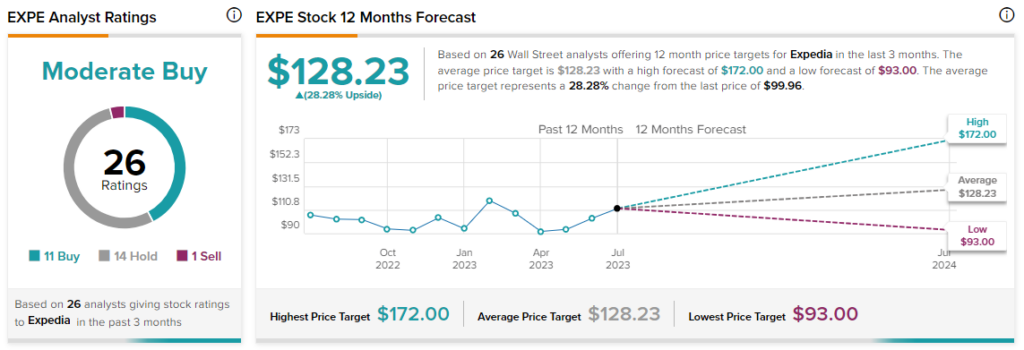

Despite this performance, shares of the company are now down nearly 3% over the past year while short interest in the stock is now inching toward 4.2%. Earlier this week, Oppenheimer’s Jed Kelly reiterated a Buy rating on the stock while increasing the price target to $135 from $120.

Overall, the Street has a $128.23 consensus price target on Expedia alongside a Moderate Buy consensus rating.

Read full Disclosure