Four of the “Magnificent Seven” tech giants—Microsoft (MSFT), Meta Platforms (META), Amazon (AMZN), and Apple (AAPL)—are set to report their earnings results this week. Wedbush analysts, led by Daniel Ives, expect strong results despite worries about tariffs. Indeed, Ives said that strong cloud spending, a rebound in digital ads, and the ongoing AI boom will likely be major positive themes for tech investors. He added that this week should improve investor confidence in these companies, although tariff concerns are still hanging over the market.

Ives explained that many businesses set their tech budgets before the latest tariff issues started, so spending on AI projects is already locked in. In fact, he estimates that about 15% of all IT budgets are now focused on AI, and companies are protecting these budgets even as they cut spending elsewhere. As a result, Wedbush believes that both Microsoft and Amazon will report strong cloud results and hint at even stronger AI demand going forward.

However, while Wedbush is bullish on Apple over the long term, Ives warned that near-term results could vary depending on how the U.S. and China handle the tariff situation. Indeed, he said that 2025–2026 earnings estimates could fall by about 10% in a base case scenario, 15–20% in a worst-case scenario, or just 2–5% if trade talks wrap up quickly. Nevertheless, Microsoft and Meta are scheduled to report earnings after markets close on April 30, while Amazon and Apple will report after the close on May 1.

Which Tech Stock Is the Better Buy?

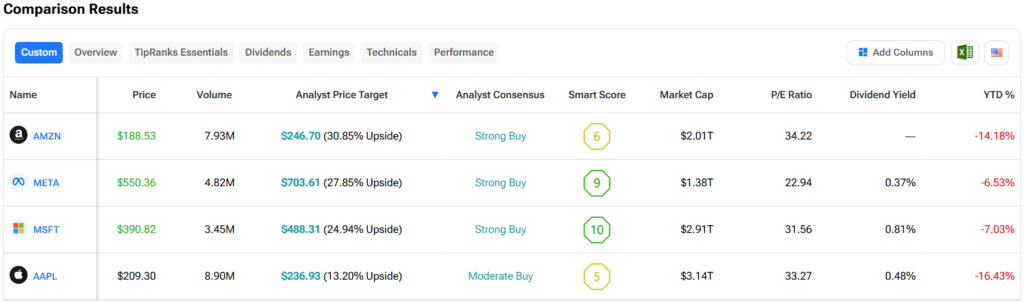

Turning to Wall Street, out of the four stocks mentioned above, analysts think that AMZN stock has the most room to run. In fact, AMZN’s average price target of $246.70 per share implies more than 30.9% upside potential. On the other hand, analysts expect the least from AAPL stock, as its average price target of $236.93 equates to a gain of 13.2%.