Amazon’s (AMZN) stock has had a disappointing year. In 2025, shares of the tech giant are up just 6%, which is far behind the roughly 18% gain for the S&P 500 (SPY). Analysts say that this weaker performance is due to slower growth at Amazon Web Services (AWS) and uncertainty around how quickly the company can turn artificial intelligence into profits. Sentiment also took a hit in October, when Amazon announced its largest layoffs ever, cutting about 14,000 corporate jobs. As a result, the stock is on pace to finish the year as the worst performer among the “Magnificent Seven.”

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Still, many Wall Street analysts remain confident in Amazon’s longer-term potential. For instance, five-star Evercore ISI analyst Mark Mahaney has named Amazon a top pick for 2026 and believes that the stock could have around 50% upside. He points to several upcoming catalysts, such as a rebound in AWS growth, strong demand for Trainium AI chips, continued momentum in advertising, and a gradual ramp of the new Alexa+ service. Mahaney also describes Amazon as a high-quality long-term compounder.

In fact, he highlighted an estimated 25% earnings growth rate, steady double-digit revenue growth, expanding margins, and the possibility of a meaningful improvement in free cash flow over the next two years. However, retail investors appear more cautious. Data from Polymarket suggests that most expect Amazon’s stock to be little changed by January 2026. Even so, JPMorgan’s (JPM) five-star-rated Doug Anmuth still sees about 30% upside and noted that Amazon’s $38 billion, seven-year cloud deal with OpenAI could provide additional growth.

Is Amazon a Buy, Sell, or Hold?

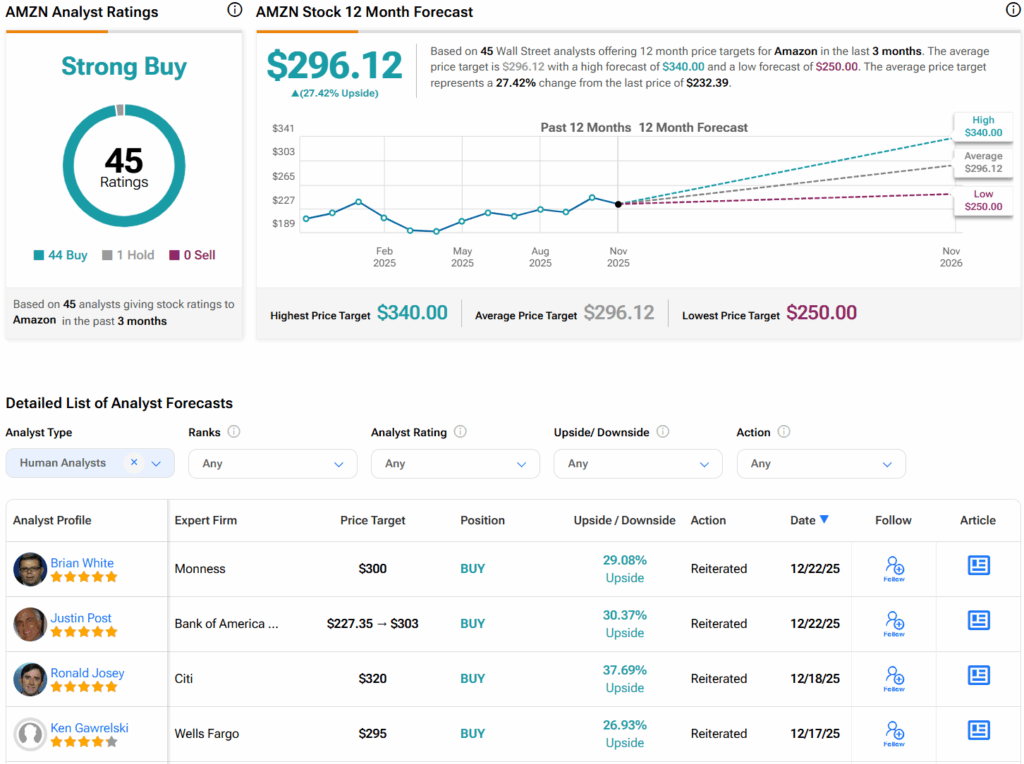

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 44 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $296.12 per share implies 27.4% upside potential.