Ark Investments, which is known for its flagship Ark Innovation ETF (ARKK), believes that internal combustion engine (ICE) vehicles are on their way out, even though news stories often make it seem like electric vehicles (EVs) are the ones struggling. In reality, data from 2024 shows that ICE vehicles are losing market share every year at a rate of about 5% per year since 2019. According to research associate Akaash TK, this shift is expected to speed up as battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) become more popular.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Although PHEVs have grown quickly recently, BEVs have been growing faster overall over the past decade. Ark explained that traditional automakers are using plug-in hybrids as a temporary solution while they figure out how to make affordable and competitive fully electric vehicles. However, newer companies that are taking advantage of cheaper battery costs may soon offer much lower-priced BEVs. Ark also said that robotaxi fleets, which could become more common, may help push ICE vehicles out of the market even faster.

Interestingly, China is already showing signs of this trend. Indeed, last year, BEVs and PHEVs together made up about 44% of vehicle sales there and cut ICE market share to 52%, which is much lower than the 80% seen in other countries. As a result, Ark thinks that Tesla’s (TSLA) upcoming affordable EV could boost global demand for electric cars even more. In addition, despite the uncertainty caused by new tariffs, TK said that BEVs are still likely to become the most affordable and best-performing type of vehicle worldwide in the future.

What Is the Prediction for Tesla Stock?

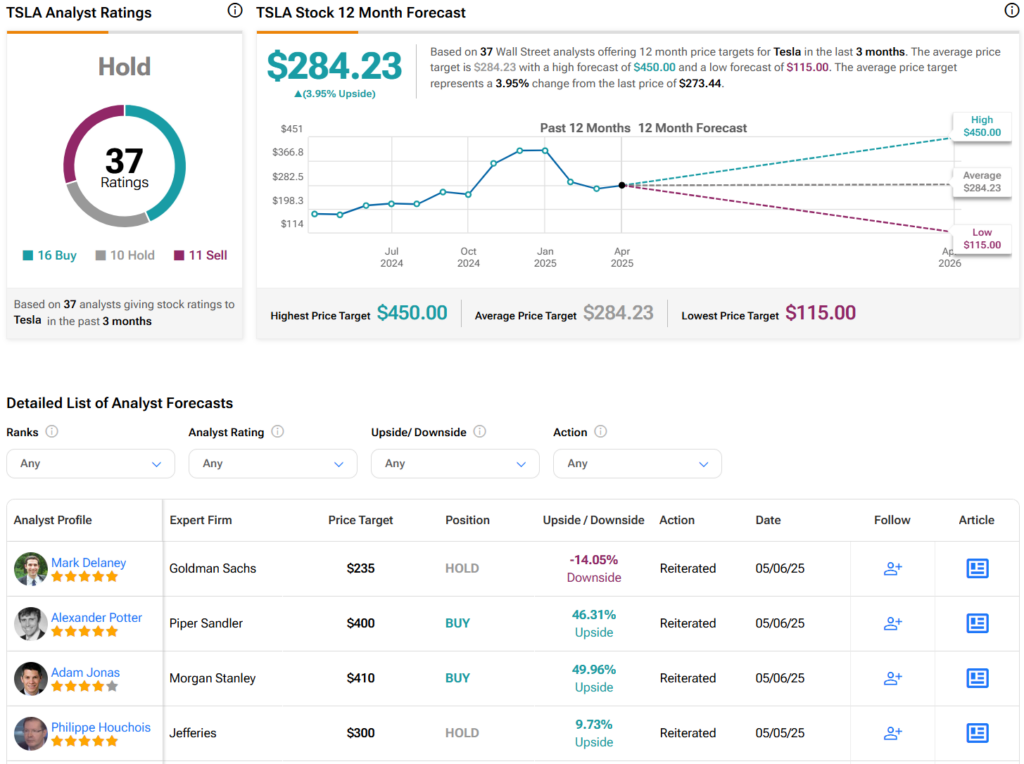

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 16 Buys, 10 Holds, and 11 Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $284.23 per share implies 4% upside potential.