It’s good news today for the EV market, as electric vehicles start to see demand recovery. A newfound focus on growth hit the field. Some of the biggest gainers were also among the most unexpected. Faraday Future Intelligent Electric (NASDAQ:FFIE) saw some of the biggest gains, but companies ranging from electric vehicle infrastructure like ChargePoint Holdings (NASDAQ:CHPT) to Tesla (NASDAQ:TSLA) saw gains.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

What drove these gains? New partnerships and developments, such as Shell (NYSE:SHEL) buying electric vehicle charging company Volta (NYSE:VLTA), a move that promised new life for the electric vehicle infrastructure field. That gave some hope to ChargePoint investors too, which led to gains until a reversal started in late morning trading.

Yet there are some troubling signs ahead as well. Reports suggest that the EV market could be in for a tough 2023, as recession fears may make electric vehicles unavailable to most potential drivers. Energy security issues may hamper their ability to recharge expediently. Ultimately, that may hinder the market right as it’s coming back. Moreover, companies like Tesla—who saw gains earlier today—may have trouble due to their sheer size. Author Robert Rubciuc noted that Tesla’s market cap leaves it susceptible to “…both earnings revisions and multiple compression.”

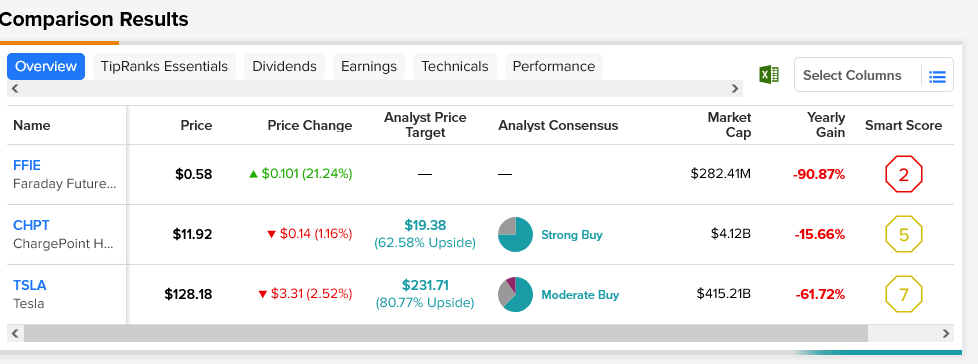

Faraday Future saw the best gains today, but Wall Street has yet to cover it. However, ChargePoint is considered a Strong Buy, while analysts call Tesla a Moderate Buy. Both stocks offer hefty upside potential; ChargePoint’s average price target of $19.38 per share gives it 62.58% upside potential. Meanwhile, Tesla offers an 80.77% upside potential thanks to its average price target of $231.71 per share.