Real-life entertainment giant Discovery, Inc. (DISCA) announced that the European Commission has granted unconditional approval for the most-awaited acquisition of AT&T’s (T) WarnerMedia business.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, shares of DISCA gained 2%, while shares of AT&T gained 1.3% on December 22.

Unconditional Approval

Earlier in May, Discovery disclosed its plan to acquire WarnerMedia, with David Zaslav serving as the CEO of the combined company.

The combined company will host the most popular and entertaining content including CNN, TBS, TNT, HGTV, Food Network, and Discovery Channel, the Warner Bros. film studio, and HBO Max and Discovery+, which are streaming services.

The European Union had taken up the matter to verify whether the combination of the two giants would hamper competition in the European market. Yesterday, Discovery announced that the European Commission issued an unconditional approval for the acquisition, opening doors for the deal to go through smoothly.

Discovery expects the deal to complete in mid-2022, pending DISCA shareholder approval and certain regulatory closing conditions. The approval of AT&T shareholders is not required.

CEO Comments

President and CEO of Discovery, David Zaslav, said, “Today we move one important step closer to creating Warner Bros. Discovery, a premier entertainment company that will be one of the world’s leading investors in premium content and one positioned to serve consumers with what we believe will be the most complete content offering under one roof.”

Analysts’ View

Recently, Citigroup analyst Jason Bazinet reiterated a Buy rating on the stock with a price target of $44, which implies a whopping 86.2% upside potential to current levels.

Bazinet believes Discovery shares could nearly double post the combination by investing in direct-to-consumer content.

Overall, the stock has a Moderate Buy consensus rating based on 4 Buys and 5 Holds. The average Discovery price target of $34.25 implies 44.9% upside potential to current levels. However, shares have lost 22.8% year-to-date.

News Sentiment

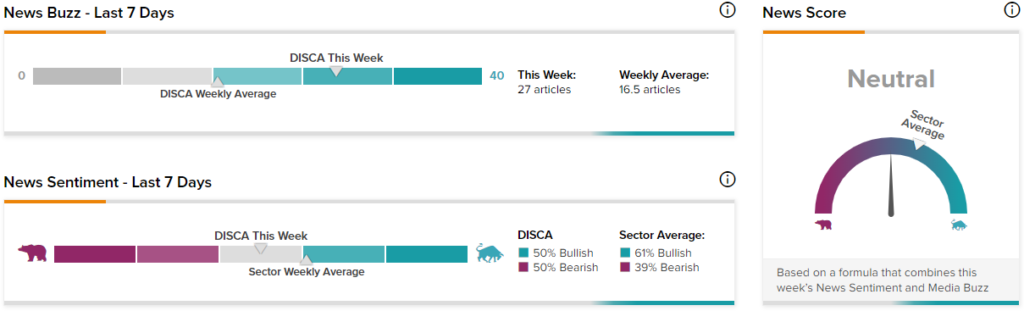

TipRanks’ News Sentiment and Media Buzz Analysis shows the combined News Score based on DISCA’s News Sentiment and Media Buzz.

TipRanks data shows that the News Score for Discovery is currently Neutral based on 27 articles over the past seven days. 50% of the articles have a Bullish Sentiment compared to a sector average of 61% while 50% of the articles have a Bearish Sentiment compared to a sector average of 39%.

Related News:

AT&T Sells Xandr to Microsoft; Shares Up

Microsoft Wins EU Antitrust Approval for $16B Nuance Deal

Kellogg’s Workers End Strike