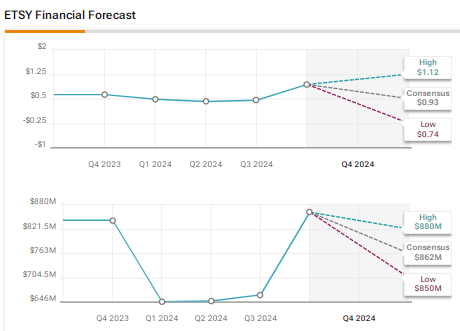

E-commerce retailer Etsy (ETSY) is scheduled to announce its results for the fourth quarter of 2024 before the market opens on Wednesday, February 19. Etsy stock has risen more than 8% so far in 2025 but is down 25% over the past year. The platform that connects sellers and buyers of unique goods and vintage items was once a pandemic darling but faced challenges after the economy reopened. Investors have been concerned about the decline in Etsy’s gross merchandise sales (GMS), reduced active seller count, and the impact of macroeconomic pressures on consumer spending. Analysts expect Etsy to report Q4 2024 earnings per share (EPS) of $0.93, reflecting a 50% year-over-year growth.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Further, Wall Street expects Q4 revenue to rise 2.3% to $861.8 million. The company has missed analysts’ earnings expectations for four consecutive quarters. Etsy has been trying to improve its performance by enhancing its platform and driving cost efficiencies.

Analysts’ Sentiment Ahead of Etsy’s Q4 Results

Heading into Q4 results, Citi analyst Ygal Arounian increased the price target for Etsy stock to $56 from $54 but reiterated a Hold rating. The five-star analyst remains cautious about the company’s GMS trends and is looking for insights into the potential impact of policy changes and signs of a GMS turnaround.

Arounian noted that Etsy continues to face challenges due to the impact of macro headwinds on non-discretionary consumer spending. In particular, he is eager to see the extent to which management’s product and platform investments can drive growth and offset the impact of macro challenges. The company’s initiatives to improve its performance include revamping search on the platform, enhancing the loyalty program, and focusing on the AI-powered Gift Mode feature.

Meanwhile, Truist analyst Youssef Squali recently lowered his price target for Etsy stock to $67 from $70 and maintained a Buy rating. The analyst stated that the Truist Card Data indicated that Etsy’s Marketplace revenue lagged the consensus and its prior estimates for the holiday period. He attributed the subdued revenue to macro pressures driving lower order frequency and average order value during the holiday season.

That said, Squali highlighted that Etsy continues to sustain its market share across many of its key verticals. The five-star analyst believes that Etsy is poised to rebound as the economy normalizes.

Options Traders Anticipate a Major Move on ETSY’s Q4 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting an 11.6% move in either direction in reaction to ETSY’s Q4 2024 results.

Is ETSY a Good Stock to Buy?

Overall, Wall Street has a Hold consensus rating on ETSY stock based on three Buys, nine Holds, and two Sell recommendations. The average ETSY stock price target of $54.85 implies a downside risk of 4.1% from current levels.