eToro wants Wall Street’s attention. The Israeli stock and crypto trading firm is charging ahead with plans to go public in the U.S., targeting a $4 billion valuation and raising $500 million in the process. The IPO will see 10 million shares priced between $46 and $50 each, according to a May 5 filing with the U.S. Securities and Exchange Commission.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

That’s not small fry for a company that had to hit pause just weeks ago. President Trump’s “Liberation Day” tariffs rattled public markets and forced several IPOs—including eToro’s—to delay. But now, it’s back on the launchpad.

eToro Offers Stock as Insiders Cash Out

Half of the shares—5 million—will come from eToro itself. The other half will be sold by company insiders, including CEO Yoni Assia and his brother Ronen Assia, along with venture backers Spark Capital and BRM Group. The company is planning to list on the Nasdaq under the ticker “ETOR.”

According to the filing, funds affiliated with BlackRock (BLK) have expressed interest in snapping up $100 million worth of shares at the IPO. That’s a powerful signal in a market still cautious on crypto exposure.

Crypto Still Powers the Engine

In 2024, eToro’s crypto revenue surged to $12.1 billion from $3.4 billion the year before. The firm said it expects crypto to make up 37% of trading commissions in Q1 2025—down slightly from 43% last year but still a hefty chunk of business.

Yet it’s not without risks. In its SEC filing, eToro warned it could lose users “as a result of media coverage or by experiencing significant losses.” It also flagged concerns over state-by-state crypto rules in the U.S. and ongoing compliance costs with Europe’s MiCA regulation.

eToro Leads a Reawakening IPO Pipeline

eToro joins a handful of crypto-native companies eyeing the public markets again. Stablecoin issuer Circle filed to go public earlier this year, and Kraken is reportedly racing to join the queue in early 2026.

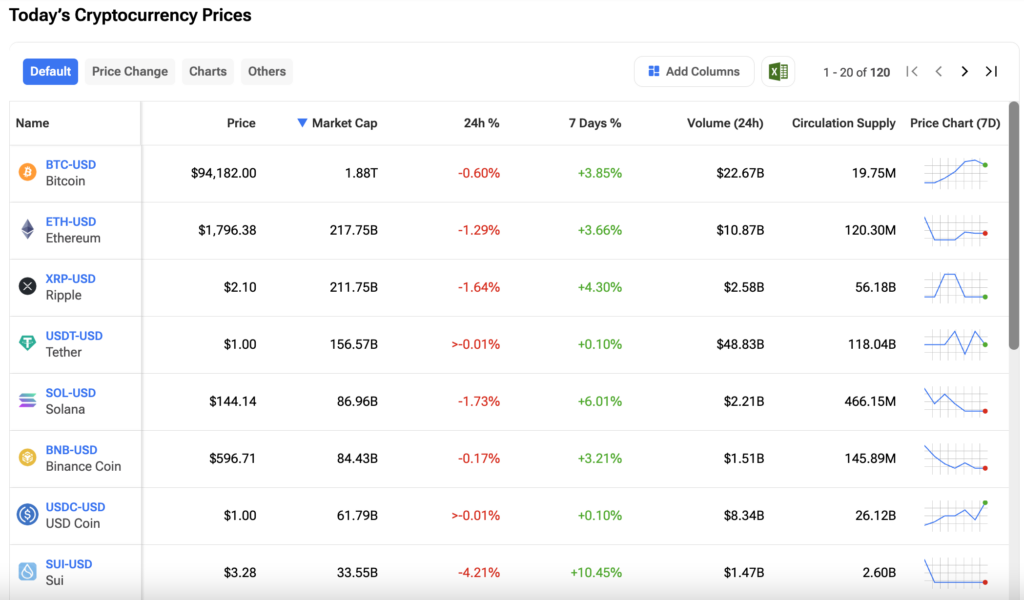

For eToro, the race is on. It’s counting on retail traders, crypto diehards, and a strong appetite for volatility to power its return to the public stage. With crypto now a central theme for eToro—and plenty of other companies—investors can track live prices and technical analysis of top tokens on TipRanks. Click the image below to explore.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue