Ethereum’s (ETH-USD) bull run has been sparked by the approval of spot ETFs and increasing regulatory certainty. This news has fueled optimism across the crypto space.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Spot ETH ETFs just got the green light las week, and it’s already paying off. ETH ETFs open the floodgates for institutional investors, giving them a safe and regulated way to dive into ETH. The demand spike from these big players is sending prices soaring.

ETH ETF Approval and Regulatory Clarity

Now that these ETFs are approved, the crypto market is waiting for them to hit the market. It might take over a month for a significant portion of the approved ETFs to become tradable. Analysts anticipate a flood of capital similar to the boom seen with Bitcoin (BTC-USD) ETFs.

Some regulatory clarity is finally here, and it’s making a world of difference. As the rules around cryptocurrencies become less murky, investor confidence is on the rise. However, there are still some concerns about how staking mechanisms will be addressed. One of the primary reasons for this is the concern that the SEC will treat staking as part of an investment contract, leading all spot ETH ETF filers who had a staking mechanism in place to remove that particular section from their initial filings for approval.

Bullish Market Sentiment

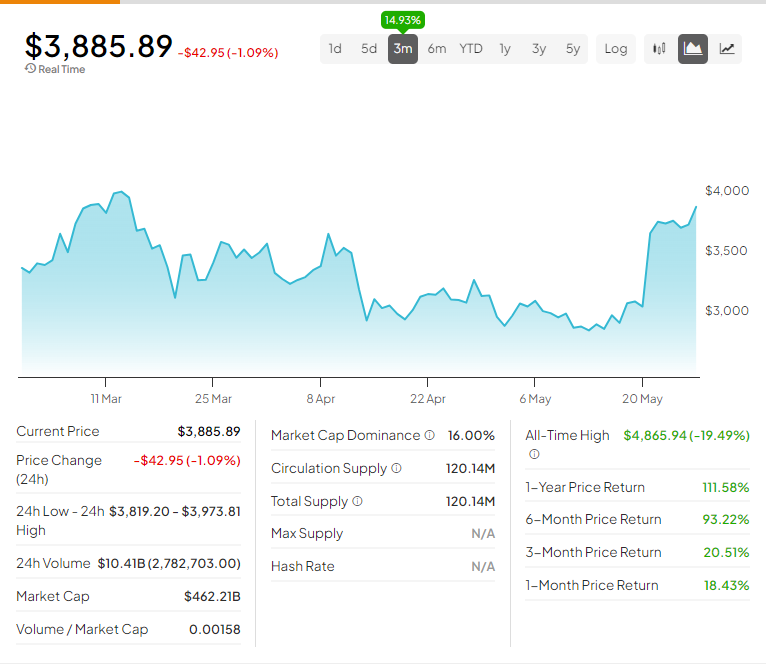

ETF approvals and a favorable regulatory landscape have created the perfect storm for Ethereum. Looking at Ethereum’s performance across multiple timeframes shows how bullish short and long-term traders are:

1-Month Return: +18.43%

3-Month Return: +20.51%

6-Month Return: +93.22%

One-Year Return: +111.58%

Despite the three-day weekend in the U.S., Ethereum closed the Memorial Day holiday higher by nearly +5% and is presently trading in the $3,900 value area.

Is Ethereum a Buy?

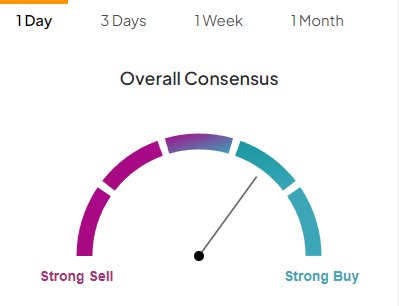

According to TipRanks’ Summary of Technical Indicators, Ethereum is a Buy.

Don’t let crypto give you a run for your money. Track coin prices here.