Ethereum’s (ETH) price has fallen 39% this year relative to Bitcoin (BTC), taking the ratio between the two largest cryptocurrencies to its lowest level in five years.

The drop in the Ethereum-to-Bitcoin ratio comes as investors sell out of riskier assets such as crypto and move into cash or safer bets such as bonds and exchange-traded funds (ETFs). At the current level, one Ethereum is the equivalent of 0.02191 Bitcoin. That’s the lowest level since May 2020, when Ethereum was trading around $200 and Bitcoin under $10,000 at the start of the Covid-19 pandemic.

Currently, Ethereum is trading at $1,800 and Bitcoin is around $82,000. The current slump between the two digital assets is especially notable because it’s the first time ever that Ethereum’s price has weakened against Bitcoin in the 12 months after a halving event. On April 20, 2024, the rewards Bitcoin miners receive for harvesting the cryptocurrency was reduced by 50%.

Market Uncertainty

In previous halving events, Ethereum outperformed Bitcoin in the following year. That hasn’t happened this time and the ratio of Ethereum to Bitcoin has fallen by more than 50%. Tariff uncertainty, signs of returning inflation, and elevated bonds yields have driven investors out of stocks and crypto in recent weeks.

At the same time, the price of gold, viewed as the ultimate safe haven asset, has climbed to record highs. The price of Ethereum has dropped 44% so far this year, while Bitcoin’s price has decreased about 12% on the year. The crypto market peaked on Jan. 20 this year, the day of U.S. President Donald Trump’s inauguration.

Is BTC a Buy?

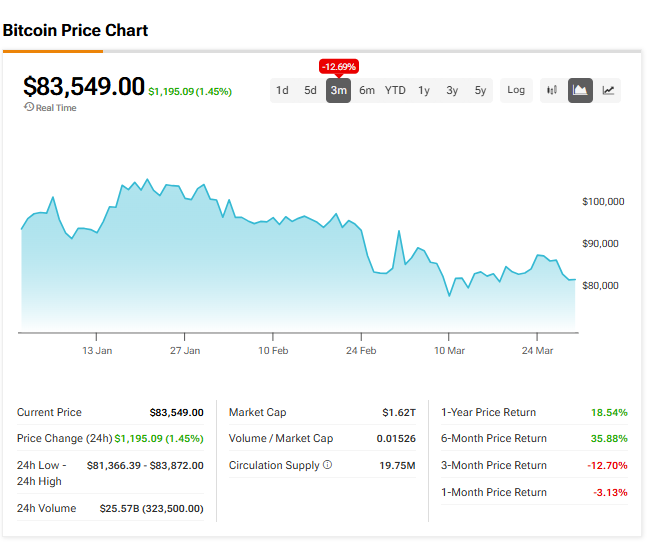

Most Wall Street firms don’t offer ratings or price targets on Bitcoin, so we’ll look at the cryptocurrency’s three-month performance instead. As one can see in the chart below, the price of BTC has declined 12.69% in the last 12 weeks.