The U.S. Securities and Exchange Commission just pulled a classic switcheroo, now seemingly ready to approve eight spot Ethereum (ETH-USD) ETFs after flipping its stance overnight. The SEC approved form 19b-4 filings from the TradFi-turned-crypto big dogs—BlackRock, Fidelity, VanEck, Grayscale, Bitwise, Ark, Franklin Templeton, and Invesco Galaxy. But hold your applause—the ETFs can’t start trading until the SEC also rubber-stamps their S-1 registration filings.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ETFs Almost Ready for Showtime

This sudden reversal by the SEC resembles the process that preceded Bitcoin (BTC-USD) ETF approvals. However, let’s not get ahead of ourselves—trading is still a few weeks away, according to Bloomberg analyst James Seyffart.

To be clear: This doesn’t mean they will begin trading tomorrow. This is just 19b-4 approval. Also, approval on the S-1 documents needs to be given, which is going to take time. We’re expecting it to take a couple of weeks but could take longer. We should know more within a week or so!” Eric Balchunas tweeted.

Ethereum’s price has ticked up 1.6% in the last 24 hours, now sitting at $3,818. The SEC’s decision implies that ETH, along with many other tokens, might dodge the “security” label. But don’t get too comfortable—analysts caution that the SEC isn’t finished with the staking crowd yet.

Implications and Industry Chatter

Approving spot Ether ETFs is the SEC’s way of saying, “ETH isn’t a security.” Bloomberg ETF analyst James Seyffart thinks this could extend to other tokens. “These are commodities-based trust shares, so the SEC, by approving these, is explicitly saying they’re not going after Ether as a security,” he noted on the Bankless podcast.

Digital asset lawyer Justin Browder says if the ETFs get S-1 approval—the final hurdle—then the “debate is over: ETH is not a security.” Venture capitalist Adam Cochran took it a step further, suggesting this could apply to other tokens, too. “ETH is a commodity, even with its current attributes.

That means we can extrapolate to A LOT of other projects,” Cochran said.

But don’t break out the confetti yet. Seyffart and others believe that the SEC might still target staking actors. Alex Thorn said on an X post that he thinks they will “try to thread a needle between “ETH” NOT being a security and “staked ETH” (or even more flimsily, “staking as a service ETH”) as BEING a security.”

Finance lawyer Scott Johnsson pointed out that the SEC didn’t confirm Ether’s non-security status in its approval order, saying it “completely sidestepped” the issue. An official statement from the SEC and some of its Commissioners is expected soon.

What’s Next?

The SEC officially approved 19b-4 applications from VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, ARK 21Shares, Invesco Galaxy, and Bitwise to issue spot Ether ETFs on May 23. Many ETF issuers dropped staking in their final amendments. Hashdex was the only ETF issuer left out in the cold on approval day.

The approved ETFs will have to cool their jets until the SEC signs off on their S-1 registration statements. BlackRock’s spot Ethereum ETF, listed on DTCC under ticker ETHA, leads the pack. Still, trading is on hold until all necessary approvals are in place.

Is Ethereum a Buy?

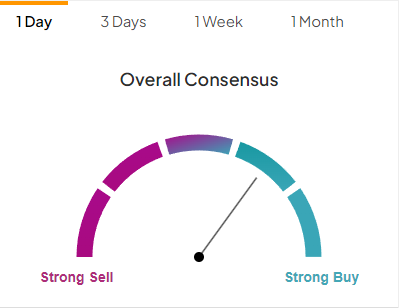

According to TipRanks’ Summary of Technical Indicators, Ethereum is a Buy.

Don’t let crypto give you a run for your money. Track coin prices here.