The crypto world is on edge as the SEC is set to announce its decision on spot Ethereum (ETH-USD) ETF applications. While many expect the SEC to reject these ETFs, some analysts believe we might be in for a surprise.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Most crypto analysts predict the SEC will deny spot Ether ETFs, but a few optimists are holding out hope. Coinbase (NASDAQ: COIN) institutional research analyst David Han thinks there’s “room for surprise to the upside.” Crypto trader Matthew Hyland, echoing this sentiment, pointed out that if everyone expects denial, who’s actually going to sell if it happens?

Bloomberg ETF analyst Eric Balchunas puts the approval odds at 35%, while the crypto community is more pessimistic, with estimates around 7%, according to Polymarket.

Han argues that as crypto becomes a key election issue, the SEC might hesitate to reject the ETFs. He believes the approval odds are closer to 30-40%. Even if the SEC denies the VanEck and ARK Invest ETF applications by the May 23 deadline, Han suggests litigation could overturn the decision.

Whale Moves Amid ETF Speculation

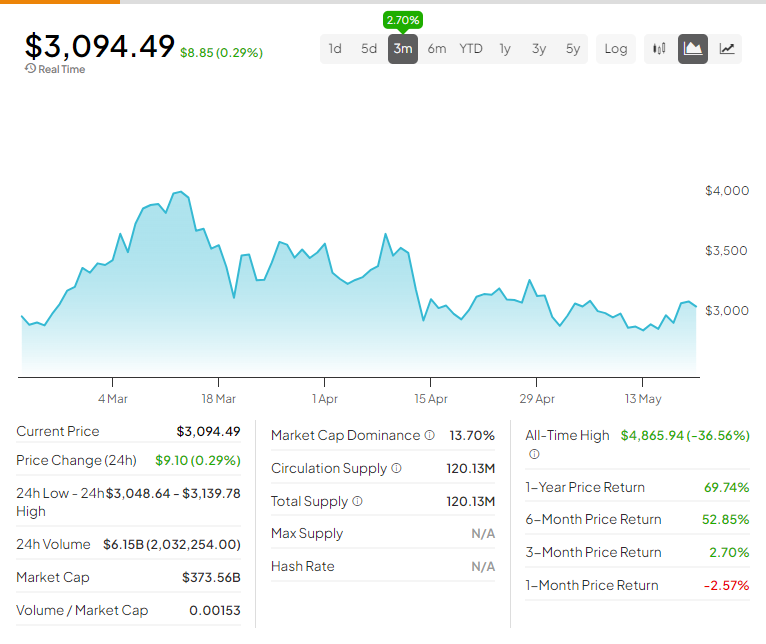

As the ETF drama unfolds, Ethereum whales aren’t sitting idle. One massive whale, who accumulated 120,000 ETH at around $1,600 each, has started cashing in. According to Lookonchain, this whale recently deposited 15,000 ETH worth $46 million on Kraken, netting a cool $171 million in profit. The whale had withdrawn 120,874 ETH from Kraken between August 31, 2022, and September 9, 2022, at $1,647 per ETH. Currently, the whale has 105,874 ETH left, valued at $325.3 million.

Keep your eyes on the charts and your ears to the ground—Ethereum’s next moves could be big.

Is Ethereum a Buy?

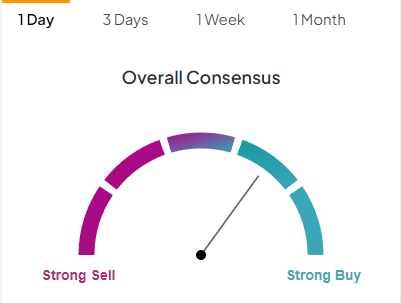

According to TipRanks’ Summary of Technical Indicators, Ethereum is a Buy.

Don’t let crypto give you a run for your money. Track coin prices here.