Cosmetics company Estée Lauder (EL) announced a major restructuring plan that aims to cut 5,800 to 7,000 jobs, or up to 11% of its workforce. The company expects to incur charges of $1.2 billion to $1.6 billion but plans to reinvest the savings to drive sales growth. The restructuring is part of new CEO Stéphane de La Faverie’s efforts to revive the company, which has struggled with declining sales in Asia and subdued consumer sentiment in China and Korea.

Estée Lauder’s sales have been impacted by challenges in its duty-free business in Asia, and the company expects sales in this segment to decline by a “strong double-digit” percentage in the current quarter. In addition, the company’s guidance for the current quarter was weaker than expected, with net sales projected to fall by 10% to 12% and adjusted earnings per share expected to decline.

Focus on High-End Cosmetics Market

De La Faverie plans to focus on gaining market share in the high-end cosmetics market by accelerating new product launches and improving marketing efforts. The company is also expanding its turnaround plan, which includes consolidating its regional organization and creating a new division focused on emerging markets. While some analysts are skeptical about the company’s ability to execute its turnaround plan, de La Faverie remains confident in the company’s ability to restore sales growth and improve profitability.

Is EL Stock a Buy or Sell?

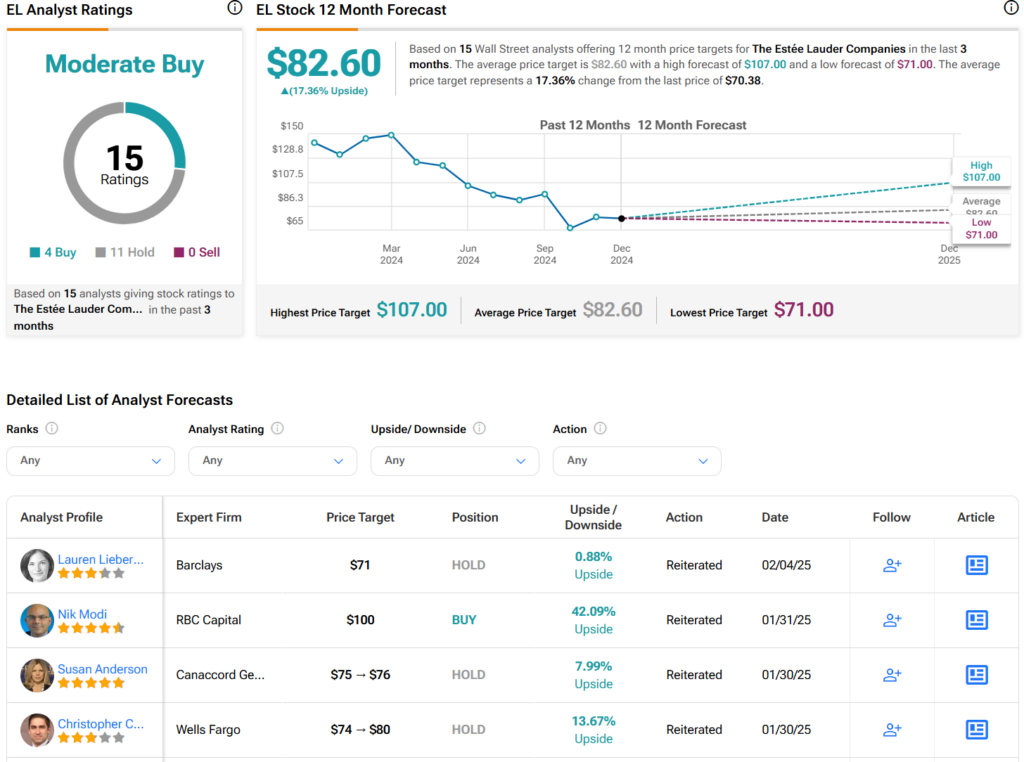

Turning to Wall Street, analysts have a Moderate Buy consensus rating on EL stock based on four Buys, 11 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 52% decline in its share price over the past year, the average EL price target of $82.60 per share implies 17% upside potential.