Shares of midstream energy services provider Enterprise Products Partners (NYSE:EPD) are trending lower today after its third-quarter EPS of $0.60 fell short of estimates by $0.04. Further, revenue of $12 billion came in 22.4% lower than the comparable year-ago period.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Despite the downturn in revenue, EPD’s adjusted EBITDA rose to $2.33 billion from $2.26 billion, and its adjusted CFFO (adjusted cash flow provided by operating activities) increased to $2.02 billion from $1.95 billion compared to the year-ago period.

During the quarter, EPD handled elevated volumes across its midstream system and placed into service nearly $2.7 billion of capital projects. Earlier this month, the company initiated operations at its Mentone 2 natural gas processing plant in the Delaware Basin.

Moreover, EPD has announced new growth projects to the tune of $3.1 billion in its NGL Pipelines and Services segment. The company now has organic growth projects worth $6.8 billion under construction, which will generate additional cash flow for EPD after becoming operational.

The company had a total outstanding debt principal of $29.2 billion and consolidated liquidity of $3.8 billion at the end of September 2023. It estimates capital investments of $3.4 billion for 2023 and between $3 billion and $3.5 billion for 2024.

Is EPD a Good Stock to Buy?

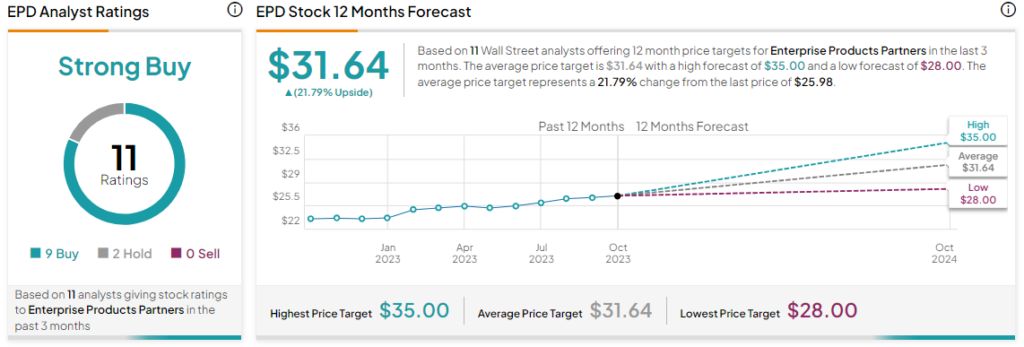

Overall, the Street has a Strong Buy consensus rating on Enterprise Products. The average EPD price target of $31.64 implies a 21.8% potential upside. That’s after a nearly 7.5% rise in EPD stock so far this year.

Read full Disclosure