Enphase Energy (ENPH) is getting a sunny response from stock traders, yet it’s safer to watch the stock than to chase it higher. Investors should take a close look at Enphase Energy’s actual data instead of just assuming that the company is on the cusp of a long-term turnaround. Consequently, I am currently bearish on ENPH stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Enphase Energy promotes itself as the “world’s leading supplier of microinverter-based solar and battery systems.” Some investors may have been concerned about Enphase Energy lately because of the collapse of SunPower (SPWR) stock. To recap that situation, Guggenheim analysts Hilary Cauley and Joseph Osha issued a $0 price target on SunPower stock and declared that SunPower’s “equity no longer has any value.”

Certainly, even though they’re both solar companies, I’m not comparing Enphase Energy to SunPower. Enphase Energy isn’t on the brink of collapse, and ENPH stock isn’t likely to go to $0 anytime soon. Nevertheless, it’s wise to conduct your full due diligence on Enphase Energy, as the market may be too cheerful about the company right now.

Enphase Energy Spikes 12% Despite Across-the-Board Misses

Enphase Energy stock is up nearly 13% to $117 today, but investors shouldn’t jump to any conclusions. Remember the old financial-market principle: when it comes to the market’s immediate reactions to earnings reports, sometimes the “first move is the wrong move.”

Apparently, stock traders were pleased with Enphase Energy’s just-released second-quarter 2024 financial report. When we drill down to the actual results and forward guidance, however, it’s challenging to see exactly what Enphase’s investors were so enthused about.

Let’s start with the basics. In Q2 of 2024, Enphase Energy generated GAAP-measured revenue of $303.458 million. That’s up from $263.339 million in the first quarter of 2024, but it’s less than half of the $711.118 million that Enphase Energy generated in the second quarter of 2023. Furthermore, that’s below the consensus estimate of $309.7 million in quarterly revenue.

There’s a similar story when it comes to Enphase Energy’s bottom-line results. The company reported Q2-2024 net income of $10.833 million, and that’s certainly an improvement over Enphase’s Q1-2024 net loss of $16.097 million. On the other hand, this result is substantially worse than Enphase Energy’s Q2-2023 net income of $157.191 million.

The point here is that while Enphase Energy demonstrated improvement on a quarter-over-quarter basis, the company still has a lot of work to do. Besides, it’s discouraging that Enphase Energy reported second-quarter 2024 adjusted earnings of $0.43 per share, as this fell short of Wall Street’s consensus call for earnings of $0.49 per share. It’s also worth noting that Enphase now has an unfortunate track record of four consecutive quarterly EPS misses.

Enphase Energy’s Not-Too-Sunny Outlook

We’re definitely starting to detect a pattern of across-the-board misses here. These aren’t ultra-wide misses, but it’s difficult to make sense of the market’s hyped-up response. Then, when we examine Enphase Energy’s current-quarter outlook, it’s even harder to justify the share-price rally.

For 2024’s third quarter, Enphase Energy expects to generate revenue in the range of $370 million to $410 million. The midpoint of that guidance range would be $390 million.

Obviously, this implies sequential improvement over Enphase’s second-quarter 2024 revenue of $303.458 million. Don’t be too quick to celebrate, though. As it turns out, the consensus estimate called for Enphase Energy to record $412 million in current-quarter revenue.

After reviewing these results and Enphase Energy’s revenue outlook, I searched high and low for a reason why traders pumped up ENPH stock. It’s possible that Enphase’s results and guidance, while below Wall Street’s expectations, came in above the market’s dour forecasts.

There’s also Canaccord Genuity (CCORF) analyst Austin Moeller’s explanation. In general, Moeller observes improvement in the U.S. solar equipment market, particularly in California, and he sees this factor as a “light at the end of the tunnel.” This may be the case, but the market ought to have known about this general trend prior to Enphase Energy’s quarterly report, so there shouldn’t have been any huge surprises.

Is ENPH Stock a Buy, According to Analysts?

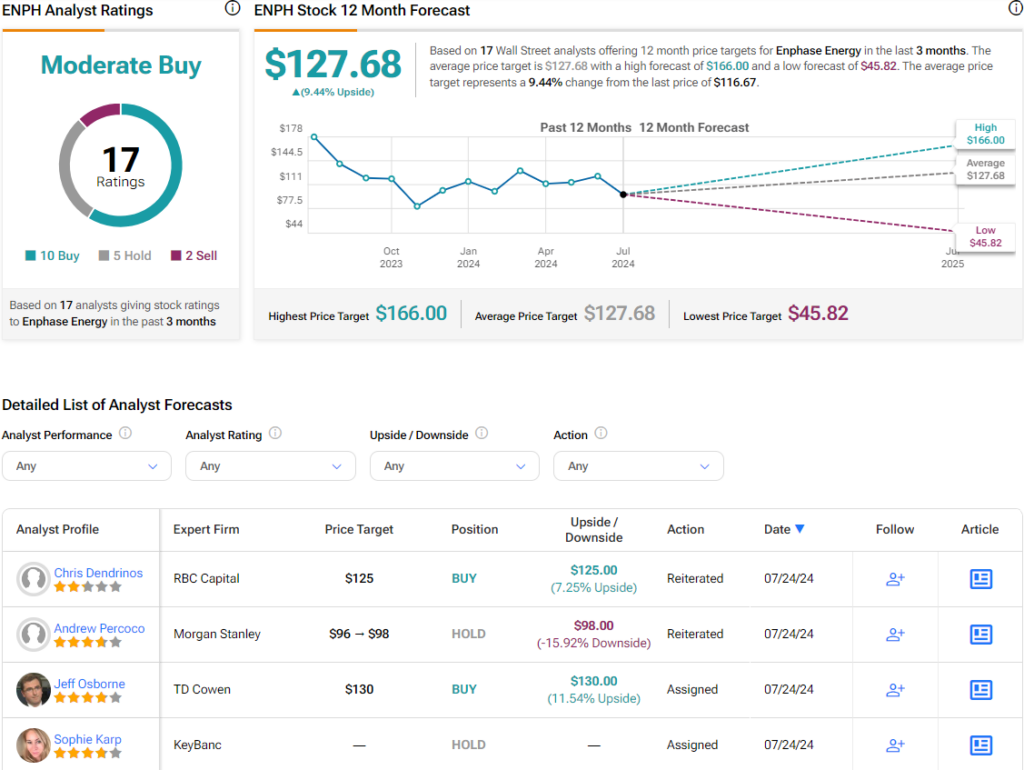

On TipRanks, ENPH comes in as a Moderate Buy based on 10 Buys, five Holds, and two Sell ratings assigned by analysts in the past three months. The average Enphase Energy stock price target is $127.68, implying % upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell ENPH stock, the most profitable analyst covering the stock (on a one-year timeframe) is Colin Rusch of Oppenheimer, with an average return of 149.62% per rating and a 74% success rate. Click on the image below to learn more.

Conclusion: Should You Consider ENPH Stock?

There’s no need to rack your brain trying to figure out why Enphase Energy stock jumped on Wednesday. Instead, I encourage you to focus your attention on Enphase Energy’s actual results and current-quarter guidance, which are decent but not stellar.

Plus, Enphase Energy still has some work to do, as the company’s results lag far behind its results from a year ago. Therefore, I wouldn’t consider buying ENPH stock now and would be on alert for a possible share-price drawdown.